NDIS Provider Accounting & Advisory

Running a successful NDIS Provider Business is about having the right foundation. We find most NDIS Providers cannot grow and have roadblocks due to not having systems in place to grow multi-location business models.

Oyster Hub team is NDIS Specialist Accountants and NDIS operational advisors who understand the NDIS Jargon for registered and non-registered NDIS providers.

Jump To

Why You Need An NDIS Accountant?

The NDIS has empowered over 450,000 individuals with disabilities in Australia. This groundbreaking initiative not only empowers them but also fosters inclusivity by ensuring access to essential services with the ability so self-manage, plan manage, and use registered NDIS providers.

However, delving into NDIS accounting complexities, from managing SCHADS Awards to ensuring compliance with regulations, requires specialised expertise; and traditional accountants may fall short in grasping these.

At Oyster Hub, we specialise in NDIS business advisory. We ensure compliance, optimise financial efficiency, and enable thriving within the NDIS framework.

Common Problems We Hear From NDIS Providers

- Managing NDIS Portal Claims and Proda Account

- NDIS Charity Registration & Compliance

- Setting up NDIS Business Structure for Growth

- Understanding NDIS software with cloud accounting

- Understanding Business financial and cashflow

- Scheduling & Rostering Staff and Payroll Timesheets

- Meeting ATO Compliance for Super, Payroll, PAYG and annual tax

- Understanding the SCHADS Awards and applying to Payroll

- Finding an NDIS bookkeeper who can ensure expenses are claimed appropriately

- NDIS Provider Payroll tax compliance and exemptions

- Running out of Participant Funding & Budget Reviews

Are you Looking for a Award Winning NDIS Accountant & Advisor?

Meet Adarsh, Co-Founder of Oyster Hub. National Award Winning Accountant, Chief Financial Officer (CFO) and Wizard of Accounting.

Adarsh has a strong passion for working with NDIS Providers to build a business that is IMPACTFUL and makes a difference to people with disabilities and helping business owners, committed to helping them reach their business, financial, and family goals.

He is passionate about making a difference in the community and committed towards closing the Gap through various projects involved in regional NSW.

Recognising the unique challenges in the NDIS landscape, Adarsh and his team proactively tackle issues, developing strategies to help NDIS providers to overcome obstacles

What Does Being an NDIS Accounting Specialist Mean?

“My lifelong passion has revolved around making a meaningful impact. Now, as a member of the advisory and governance team at Oyster NDIS Group, I have the opportunity to amplify that impact even further. Steering the strategic course and providing CFO advisory services for a prominent national NDIS provider with a workforce of over 300+ support professionals, we are dedicated to delivering services on a national scale.”

01

Explore How We Help with Business Structure Setup and Advisory For NDIS Providers

Are you an NDIS provider with a large business turnover but little profits and cash flow and have a large ATO debt and outstanding business compliance obligations?

Book a consultation with our NDIS consultant.

Oyster Hub is an award-winning accounting firm with a perfect one-stop solution for NDIS service providers like you.

At Oyster Hub, we specialise in offering expert guidance to help you make the right choices for your business’s structure. Whether you need assistance with setting up your business or managing heavy compliance requirements, we’re here to simplify the process.

We Can Help NDIS Providers with:

Are you overwhelmed and have not found an NDIS service provider till now?

Are you looking for NDIS accounting services?

Rescue Catchup

Accounting For NDIS Providers

Rescue Catchup Accounting for NDIS Providers who will help you get your accounting and taxation obligations back on track.

We are offering small business owners who are feeling stuck and are finding it hard to deal with ATO. Our rescue accounting process includes:

1. Make A Call

Start your journey to tax savings by giving our team a call. We’ll help you determine if your business is eligible for a Second Opinion, and discuss the information we need from you to complete the review.

2. Comprehensive Assessment

Our team will conduct a thorough analysis of your information to identify any areas that could be improved. We will focus on uncovering opportunities that will save you time, reduce your current year’s tax bill, and enhance the overall business performance.

3. Second Opinion Report

Once our team has completed the review, we’ll create your Second Opinion Report which includes a detailed overview of our findings and recommended solutions. The report is yours, no strings attached!

Oyster Hub is a cloud based accounting firm similar to Carter’s Tax Advisory helping business owners in Adelaide with rescue accounting related work.

03

NDIS Operational

Business Advisory

This is the Truth. Despite substantial NDIS income, many businesses operate at a loss. Our expertise lies in bridging this gap. We help NDIS providers like you strike the perfect balance, ensuring your income aligns harmoniously with your operational costs. Through our specialised services, we provide tailored solutions to achieve financial sustainability and unparalleled success within the NDIS industry.

Stay updated with the latest industry standards and regulations through our Schdes Awards Advisory.

Enhance your workforce management and policies with our comprehensive HR review services.

Streamline your administrative tasks and compliance with our efficient Proda Portal support.

Optimise your financial strategy and tax obligations with our expert Payroll Tax Advisory.

Structure your NDIS team Roosting, Scheduling, Team leaders and Management to drive your business.

Working with your business goals, mission and objectives and aligning them to the financial goals for the organisation to succeed.

04

NDIS Business Business Charity Setup & Adviosry

We find most NDIS providers operate for the good of the community through programs, advocacy and are passionate about making a difference for people living with disability.

However, they end up paying unnecessary tax obligations which puts most large organisations in a very difficult cash flow position paying high payroll tax, business tax and missing out on government benefits and grant opportunities.

You may be operating in a wrong business model if you are an NDIS provider having monthly payroll costing you over $95k. Our NDIS Advisory includes tax planning, business structure reviews and restructuring your business to suit your mission and minimising your taxes.

Get access to guidance in establishing effective board meetings and meeting ACNC reporting requirements to ensure compliance with regulations and standards.

We help you identify and leverage opportunities to maximise your financial resources and minimise expenses.

Australian taxation laws provide generous tax concessions for not for profit organisations like Barnardos Australia. One such concession is an exemption for Fringe benefits tax (FBT).

Get insights to help you manage and optimise your payroll tax obligations while ensuring compliance and reducing your tax liability.

NDIS Charities must be registered with the Australian Charities and Not-for-profits Commission (ACNC) before they can be endorsed by the Australian Taxation Office (ATO) to access charity tax concessions.

Income Tax Exemption

Income tax exemption is an exemption from paying income tax, removing the need to lodge income tax returns. Entities that are endorsed as income tax exempt are entitled to a refund of franking credits on franked dividends they receive.

GST Concession

There are a range of goods and services tax (GST) concessions for transactions involving endorsed charities:

- Gifts and GST credit adjustments – adjustments for GST credits are not required where an item acquired by a business is subsequently gifted to the charity.

- Accounting on a cash basis – the charity may choose to account on a cash basis regardless of its annual turnover.

- Non-commercial activities – where the charity makes sales and the payment it receives in return is less than a certain amount, the sales are GST-free.

- Donated second-hand goods – sales of donated second hand goods by the charity are GST-free.

- Raffles and bingo – tickets to raffles and bingo sold by the charity are GST-free provided the holding of the raffle or bingo event does not contravene a state or territory law.

- Fundraising events – the charity may choose to treat all supplies it makes in connection with certain fundraising events as input taxed. The charity is not required to remit GST on supplies made in connection with the event. However, the charity is not entitled to claim GST credits for related purchases.

- Non-profit sub-entities – the charity has the option of treating any of its separately identifiable branches as separate entities for GST purposes. Provided that the annual turnover of the non-profit sub-entity is less than $150,000, the sub-entity is not required to register for GST. An unregistered non-profit sub-entity does not remit GST on sales and does not claim GST credits for purchases.

- Reimbursement of volunteer expenses – the charity can claim GST credits for reimbursements made to volunteers for expenses the volunteer incurs that are directly related to their activities as a volunteer of the charity.

Salary packaging

Australian taxation laws provide generous tax concessions for not for profit organisations like Barnardos Australia. One such concession is an exemption for Fringe benefits tax (FBT).

This means an employer are able to pass on to their employees a proportion of their wages as a reimbursement of personal expenses and no income tax is payable on this money, in effect a proportion of your salary each pay is tax free. (Salary packaging)

You may choose to package a range of items, such as your mortgage, rent, school tuition fees, private health insurance or even a personal loan repayment, or you may decide to use our convenient Salary Packaging Payment Card (Encompass) to package everyday living expenses including groceries, clothing and utility bills.

If you choose to package your salary (it is an option) money is deducted from your salary pre-tax. You pay tax only on the remaining portion of your salary not the salary packaged money, significantly reducing the income tax you pay.

Packaging a Vehicle

Barnardos employees working over 17.5 hours per week and employed on pay level 33 or above of the Barnardos Australia Enterprise Agreement 2011 have the option of packaging a vehicle as part of their salary. The Barnardos Australia vehicle is available to you for both business and personal use and is of significant value to our staff.

Public Benevolent Institute(PBI)

A Public Benevolent Institution (PBI) is a type of charity which has a predominant (main) purpose of relieving needs arising from conditions such as poverty, sickness, distress or helplessness. This is known as providing ‘benevolent relief’.

For a need to attract benevolent relief, it must be significant enough, and the circumstances difficult enough, to arouse a feeling within the community that action should be taken to relieve it.

The characteristics of a PBI are:

- it is a charity

- it is an institution

- it is set up to relieve needs requiring benevolent relief

- it relieves the needs through providing goods and/or services which are directed to people who are in need

- its predominant (main) purpose is providing benevolent relief.

Examples of public benevolent institutions include:

- some organisations providing services for the homeless, such as shelters and meals

- some hospitals and hospices

- some disability support services

- some aged care services

- some providers of low rental or subsidised housing, for people in need

- some organisations that undertake active fundraising activities to generate income for a partner with a common purpose of providing benevolent relief, where the partner provides services to people in need of benevolent relief.

PBIs must be registered with the ACNC as a charity and as the PBI subtype of charity before they can be endorsed by the ATO to access tax concessions available to PBIs.

Are you overwhelmed and don’t know what to do? Looking for NDIS accounting services?

05

NDIS Accounting & Taxation Services for Small Business Owners

Proper accounting and taxation is a strong base for small businesses. It helps them watch over all their money matters carefully, from their profits to their expenses.

Our comprehensive bookkeeping and accounting services are designed to keep you on top of your financial records. Let us help you lay the groundwork for lasting success.

- Annual Company Tax Returns & Financial for Small Business Owners

- Preparation of consolidated reporting for Group Entities

- Lodgement of Fringe benefits tax (FBT) reports

- Lodgement of Small Business Owners Business Activity Statements

- Lodgement of Contractor Reports (TPAR) for Small Business Owners

Our Tax Refund Review Process is designed to help you navigate the complexities of tax filings, identify potential opportunities for refunds, and ensure compliance with the latest tax regulations.

1. Make A Call

Start your journey to tax savings by giving our team a call. We’ll help you determine if your business is eligible for a Second Opinion, and discuss the information we need from you to complete the review.

2. Comprehensive Assessment

Our team will conduct a thorough analysis of your information to identify any areas that could be improved. We will focus on uncovering opportunities that will save you time, reduce your current year’s tax bill, and enhance the overall business performance.

3. Second Opinion Report

Once our team has completed the review, we’ll create your Second Opinion Report which includes a detailed overview of our findings and recommended solutions. The report is yours, no strings attached!

4. Report Walkthrough

We will schedule a 1-hour meeting in-person, via Zoom, or on the phone to go over the Second Opinion Report with you. This is to ensure that you have a clear understanding of the report’s contents, all your questions are answered, and that you fully agree with the next steps to take.

06

Bookkeeping & Payroll Services for NDIS Providers

Bookkeeping and payroll services gives your business an advantage to not only ensure accurate financial records and payments but also empower you to make informed decisions that lead to substantial cost savings.

Our team of experienced bookkeepers and accountants use innovative technology to streamline your financial processes and catch any mistakes before they become a problem.

This is how we help Small Business Owners through Bookkeeping:

- Fixed Fees for Bookkeeping & Payroll

- Cloud Bookkeeping Software

- Receipt Capturing connected to your software

- Dedicated Bookkeeping Expert

Moving away from traditional bookkeeping methods and transitioning to modern digital alternatives like accounting software will diminish the likelihood of inaccuracies which helps significantly ensure precision and currency of your financial records. Additionally, it frees up valuable time, enabling you to concentrate more on key business operations.

How do you know you are using traditional methods for your bookkeeping services:

- You keep collecting all your receipts in a shoebox.

- You manually record all of your business receipts and bank transactions.

- Your bookkeeper doesn’t provide regular updates on your business’s cash flow position.

- You have to follow up on your bookeeper or accountant for business reports.

Beyond mere convenience, cloud-based accounting holds significant importance for small businesses. It not only automates tasks but also ensures a high level of accuracy. This also streamlines financial management, offering small businesses the efficiency and precision they need to thrive in their industry.

Cloud Accounting Software we Use

Join countless small business owners in Adelaide who have already discovered the power of financial efficiency with leading cloud accounting software providers: Xero, QuickBooks Online, and MYOB – cloud accounting solutions that bring you streamlined finances, greater control, and informed decision-making.

Make a switch and book a discovery call with us today.

For small business owners in Adelaide, bookkeeping and accounting play crucial roles in effectively managing their finances. While these two functions might appear similar at first glance, there are distinct differences that set them apart.

Bookkeeping focuses on recording and organising financial data. Accounting is the interpretation and presentation of that data to business owners and investors.

Bookkeeping typically consists of:

- payroll

- invoicing

- receipts and bills

- recording business transactions

Accounting typically consists of:

- financial statements and reports

- budgets

- tax returns

- analysing business performance

Bookkeeping and accounting are two essential functions that play a crucial role in managing the financial aspects of a small business. By grasping the differences between these functions, small business owners can make informed decisions, maintain accurate records, and navigate the complexities of financial management more effectively.

07

NDIS SCHADS Awards

The SCHDES Awards present a significant challenge for NDIS providers, as many struggle to interpret and adhere to its regulations, leading to Fair Work claims and court cases. It’s common for NDIS providers to lack awareness of the payroll and HR obligations associated with SCHDES Awards. Oyster Hub offers solutions to address these compliance issues, providing NDIS providers with business operational reviews, payroll audits, and guidance to ensure they follow the regulations and avoid underpaying or overpaying their staff.

The SCHADS award, which pertains to the Social, Community, Home Care, and Disability Services Industry, is known for its complexity and confusion, making compliance a daunting task. To mitigate pay rate errors, it’s essential for employers to incorporate awards compliance into their rostering and time tracking processes, ensuring they meet minimum pay rates and other requirements outlined in the award.

How We Can Help:

The SCHADS Award covers employers in:

- Crisis assistance and supported housing sector

- Social and community services sector

- Home care sector

- Family day care scheme sector.

However, the SCHADS Award doesn’t cover employers and employees who are covered by the following award:

- Aged Care Award

- Amusement, Events and Recreation Award

- Fitness Industry Award

- Health Professionals and Support Services Award

- Nurses Award

When it comes to NDIS SCHADS Awards, there are three key employment categories:

- Full-Time Employees: To qualify as a full-time employee under the NDIS SCHADS Award, you should meet one of the following criteria:

- You are contracted to work 38 ordinary hours per week.

- You average 38 hours per week over four weeks.

- You are considered a full-time employee at your workplace, even if you work less than 38 hours per week.

- Part-Time Employees: To be classified as a part-time employee under the NDIS SCHADS Award, you must meet the following conditions:

- You work fewer than 38 ordinary hours on a reasonably predictable basis.

- You have a written agreement that outlines a regular pattern of work, although it doesn’t necessarily guarantee the same number of hours each week. Starting from 1 July 2022, the NDIS SCHADS Award introduced a minimum engagement period for part-time employees, with specific minimum hours applicable, varying depending on the type of employee.

- Casual Employees: Casual employees under the NDIS SCHADS Award are characterized by their irregular work patterns and a lack of guaranteed hours. They receive an hourly rate equivalent to that of full-time and part-time employees, along with an additional 25% loading to account for the absence of entitlements like annual leave, personal/carer’s leave, and redundancy benefits. Minimum hours also apply to casual employees, varying by sector. Additionally, casual employees have the right to request conversion to full-time or part-time employment, provided they meet certain criteria related to regularity of work. Employers must consider such requests and can only refuse them based on specified grounds, as outlined in the NDIS SCHADS Award, with decisions to be made within 21 days of receiving the request.

08

NDIS VA Outsourcing

Scaling your NDIS services to meet growing demands is indeed challenging, especially while upholding the quality of care NDIS participants deserve.

Oyster Hub understands this predicament, and that’s where our outsourcing and Virtual Assistant (VA) solutions become invaluable. Our outsourcing and VA solutions are meticulously designed to streamline your operations, allowing you to focus on what matters most – delivering exceptional care. Here’s why Oyster Hub’s Outsourcing and VA Solutions are essential for your scaling journey:

Let Oyster Hub's VAs handle time-consuming administrative tasks, empowering you to excel in delivering top-tier care to NDIS solutions.

We provide a cost-effective alternative to in-house teams, allowing you to allocate resources where they matter most—delivering high-quality NDIS services.

We offer the flexibility your organisation needs to adapt and thrive in the ever-evolving NDIS landscape, ensuring you're always prepared to meet the demand.

Equipped with the latest tools, our VAs streamline your daily operations, enabling you to serve more participants without compromising quality.

Oyster Hub's VAs provide uninterrupted assistance for your participants, ensuring they have access to support whenever they need it. Your peace of mind is our commitment.

Are you overwhelmed and have not found an NDIS service provider till now? Are you looking for NDIS accounting services?

09

NDIS Property Finance

At Oyster Hub, we specialise in guiding NDIS providers towards these lucrative investments, offering expert assistance to secure loans and funding.

Our dedicated team is committed to providing the knowledge and support needed to seise control of your financial destiny.

Access exclusive investment opportunities designed to boost your personal wealth.

Unlock the power of positive gearing with NDIS properties, ensuring a continuous income stream and capital growth.

Get ahead with our NDIS Property Finance solution, your direct path to financial success. Get this now and watch your wealth soar!

NDIS AUDIT

Audit Liaison Policies & Procedures

NDIS Audit Liaison Policies & Procedures are a structured set of guidelines, protocols, and documented processes specifically designed to assist NDIS providers in meeting and maintaining compliance with NDIS regulations. They are your compass in the often intricate landscape of NDIS requirements, helping you navigate the audit process efficiently and with confidence.

Oyster Hub, your gateway to NDIS Audit Liaison excellence. In the intricate world of disability support services, NDIS compliance isn’t just a checkbox; it’s your ticket to trust, quality, and accountability. Our specialised NDIS Audit Liaison Policies & Procedures are meticulously designed to lead you to compliance and beyond.

How can Oyster Hub Help You With NDIS Audit Liaison Policies & Procedures?

Our policies provide a clear, step-by-step roadmap to meet NDIS regulations, simplifying complexity into manageable tasks.

Our policies stay current with evolving NDIS regulations, ensuring ongoing compliance and peace of mind.

Our auditors, compliance specialists, and consultants deeply understand NDIS compliance intricacies to make you excel.

Oyster Hub has a track record of helping NDIS providers achieve and maintain compliance with NDIS standards.

HOW

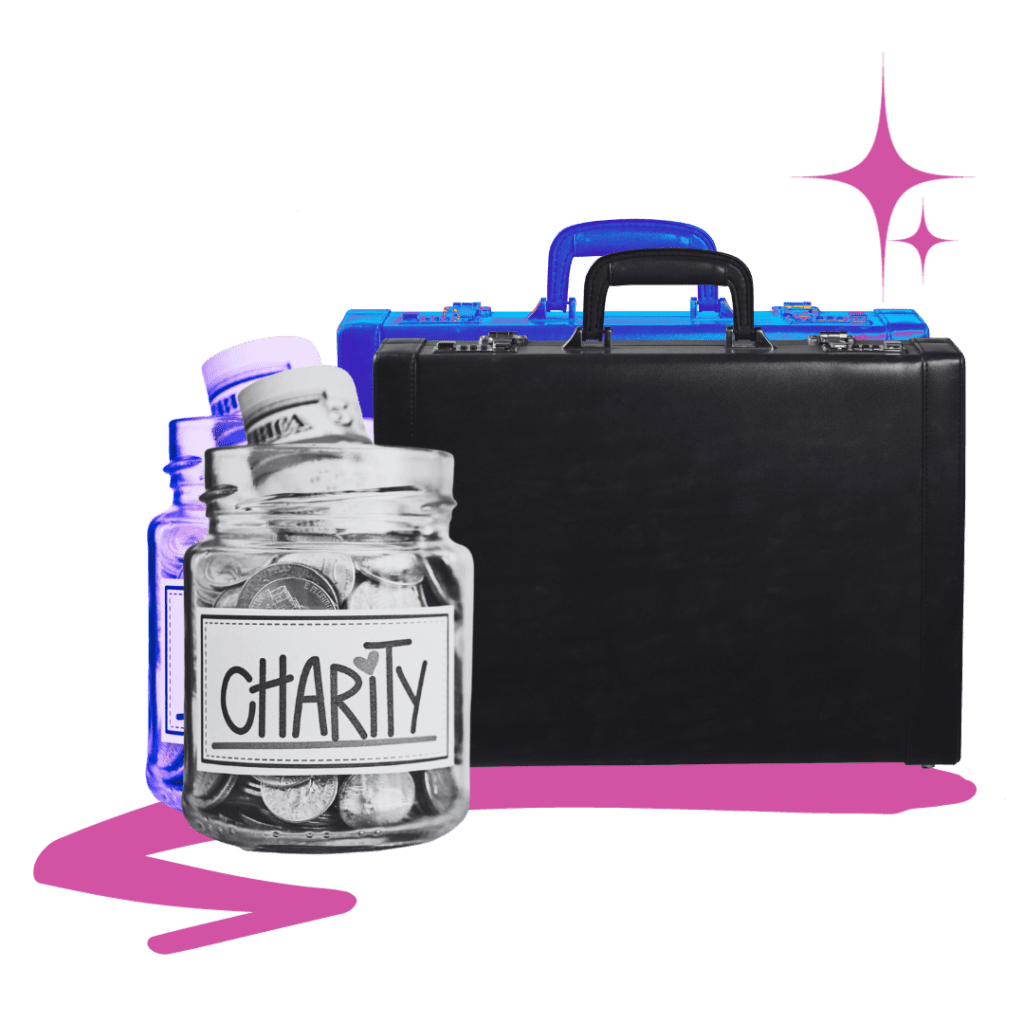

Court Order for Administration Case Study

Disability Services Australia have Appointed KPMG as their Administrators

One of Australia’s largest disability services providers has entered voluntary administration.

The NSW based not-for-profit organisation, Disability Services Australia, has more than 1600 staff and 1500 participants who benefit from its services confronting uncertainty.

Disability Services Australia faces substantial debts with large creditors, necessitating a strategic approach to debt management.

The organisation is under significant cashflow pressure, posing challenges in meeting operational expenses and sustaining service delivery.

Disability Services Australia operates in an environment marked by ongoing changes, including regulatory shifts and evolving industry standards.

Feeling lost? here are some related tags to help you navigate!

Need an expert wizard?

Come and have a chat with our friendly staff about your next big steps.

RESCUE EXPERTS

How to Know That You Need a Rescue Accountant

Get a SECOND rescue opinion for your Small Business for your previous year’s tax returns if you have PAID High Tax Bills.

We find that most business owners are heading toward a business crisis if they identify the following in your business.

Drowning In Paperwork

Low Business Cashflow

Paying High Tax Bills

Accountant is working like a sloth

IMPACT

Is Your Business Creating an IMPACT ?

Small business owners constitutes to approximately 94% of all businesses in Australia. As a business owner, are you making a positive making an IMPACT on the community, for your loved ones, or for yourself? What’s your legacy?

At Oyster Hub, our co-founders share a close working relationship with small business owners like yourself. Our mission is to help you create a business that brings joy, makes a positive impact, and leaves a lasting legacy. This is only possible if you are able to free yourself from from the day-to-day operational tasks. We are here to guide and support you in making a positive impact.

Get in Touch With Our Team of NDIS Tax Accountants Today

NDIS tax and financial complexities can be daunting, but our specialised NDIS tax accountants are here to simplify the process. We’ll customise a tax plan to suit your unique NDIS needs, minimising tax liabilities and freeing up vital resources for your core services.

Lets Have A Chat

We focus on relationships with our clients, being available to answer any business, accounting, or tax questions you have.

What People Love About Us

I have never found a more passionate finance broker than Vik and his team at Oysterhub. We were about to lose our house when our business took a down shift. Vik saved us from getting a finance deal approved when banks shut the door at us. It's great to work with people who actually care about people not just profits.

I have never seen someone more passionate tax accountant than Adarsh about wanting to help people save time on their menial processes - makes me wonder the experiences in business he has gone through but I'm not complaining I am thankful for it. He is the only tax accountant who has helped me save an extra 8-10 hours per week on lazy accountant tasks and facilitate in enabling me to put these tasks to more productive areas.

- See More