Small Business Accountants in Brisbane

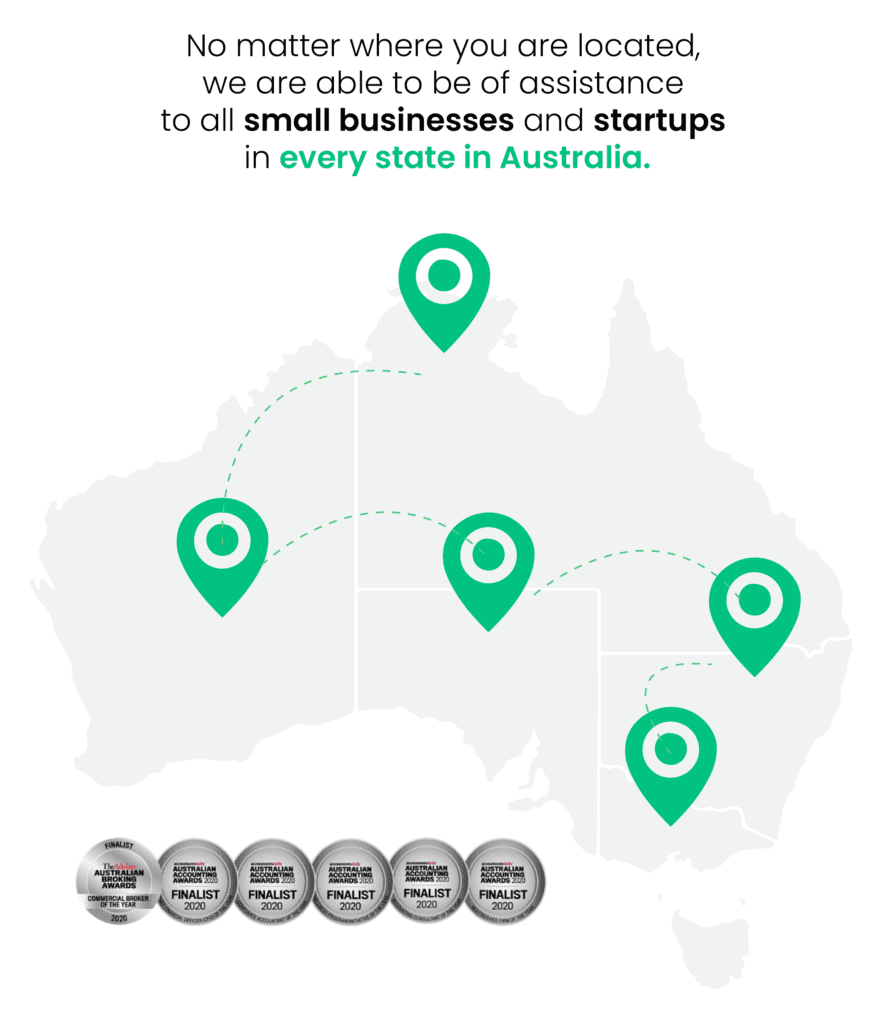

Being a small business owner entails numerous responsibilities, and while it may be tempting to set aside bookkeeping and accounting, doing so can prove detrimental to your business. Furthermore, different states and jurisdictions have varying tax rules and regulations that businesses must adhere to. At Oyster Hub, we wholeheartedly advocate simplifying your workload, allowing you to focus on core operations and easing that burden with our accounting and bookkeeping services.

Our team of experienced small business accountants in Brisbane is well-equipped to assist you in alleviating your financial concerns. We provide tailored advice and guidance to ensure your financial affairs are expertly managed, allowing you to focus on growing your business.

Jump To

Why You Need An Accountant in Brisbane

Year after year, numerous small business owners in Brisbane find themselves feeling trapped in the never-ending cycle of business complexities— from overwhelming pending paperwork, relentless dealings with the ATO, overwhelming tax liabilities, and a lack of reliable business advice. If you’re caught in the struggle, you need Rescue Tax Accounting.

Starting a business should be an exciting journey, not a tough challenge. At Oyster Hub, we specialise in extending tailored support to small business owners in Brisbane, enabling you to navigate through complex ATO requirements with ease. We offer a comprehensive one-stop solution for Accounting, Taxation, Bookkeeping, Payroll, and Business Advisory services, allowing you to focus on growing your business without being bogged down by reporting and administrative burdens.

How Our Accountants Help Small Business Owners in Brisbane:

When accountants aren't responsive, it can create delays in handling finances and addressing important questions, resulting in missed deadlines and confusion in managing finances.

- Timely and Easy ATO Compliance

- Rescue Tax Accounting

- Minimise Tax Liabilities

- Personalised Business Support

- Work With Us

Are you Looking for a Brisbane Accountant?

Meet Adarsh, Co-Founder for Oyster Hub Accountants & Business Advisors. He has a strong passion for working with start ups and small business owners, committed to helping them reach their business, financial, and family goals.

Adarsh and his team of tax accountants, business advisors, and financial brokers are experts in their field and possess extensive knowledge and experience.

Adarsh is an award-winning accountant who recently won the prestigious Australian Accounting Awards as the Chief Financial Officer.

He has been recognised in various industry publications and events for his focus on helping business owners find purpose and balance while managing their businesses.

In a recent campaign by Intuit QuickBooks, he was named “The Wizard of Accounting.”

There is a wizard in every business and we empower small businesses to make a better business to create a difference.

To learn more about Adarsh and his wizardry in accounting, avoid sloth accountants and talk to a real one today!

HOW WE CAN HELP

How We Can Help with Your Small Business in Brisbane

Oyster Hub goes beyond traditional accounting services by offering cloud accounting software solutions that enhance our client’s financial success. Our dedicated team of accountants provides personalised attention and expert guidance, particularly during complicated situations, ensuring seamless integration and utilisation of the cloud accounting software.

Unlock your financial potential with these Cloud Accounting Software Solutions

Are you a start-up business struggling to keep up with your accounting and bookkeeping?

Explore How We Help Small Business Owners Scale Their Business

Small business owners often find themselves bogged down by admin tasks, which diverts their attention from growth-focused activities. Oyster Hub is an award-winning accounting firm with a perfect one-stop solution for small business owners in Brisbane.

Whether you’re a start-up, a growing business, or a well-established company, our team of specialists is dedicated to providing unparalleled support and expert advice tailored specifically to your needs.

Are you overwhelmed with the amount of paperwork stacking up on your desk? Do you feel like you’re falling behind or getting chased by ATO for overdue lodgments?

Rescue Catchup

Accounting For Small Business Owners

Rescue Catchup Accounting for small business owners in Brisbane will help you get your accounting and taxation obligations back on track.

We are offering small business owners who are feeling stuck and are finding it hard to deal with ATO. Our rescue accounting process includes:

1. Make A Call

Start your journey to tax savings by giving our team a call. We’ll help you determine if your business is eligible for a Second Opinion, and discuss the information we need from you to complete the review.

2. Comprehensive Assessment

Our team will conduct a thorough analysis of your information to identify any areas that could be improved. We will focus on uncovering opportunities that will save you time, reduce your current year’s tax bill, and enhance the overall business performance.

3. Second Opinion Report

Once our team has completed the review, we’ll create your Second Opinion Report which includes a detailed overview of our findings and recommended solutions. The report is yours, no strings attached!

Oyster Hub is a cloud based accounting firm similar to Carter’s Tax Advisory helping business owners in Brisbane with rescue accounting related work.

01

Accounting & Taxation Services for Small Business Owners

Proper accounting and taxation is a strong base for small businesses. It helps them watch over all their money matters carefully, from their profits to their expenses.

Our comprehensive bookkeeping and accounting services are designed to keep you on top of your financial records. Let us help you lay the groundwork for lasting success.

- Annual Company Tax Returns & Financial for Small Business Owners

- Preparation of consolidated reporting for Group Entities

- Lodgement of Fringe benefits tax (FBT) reports

- Lodgement of Small Business Owners Business Activity Statements

- Lodgement of Contractor Reports (TPAR) for Small Business Owners

Our Tax Refund Review Process is designed to help you navigate the complexities of tax filings, identify potential opportunities for refunds, and ensure compliance with the latest tax regulations.

1. Make A Call

Start your journey to tax savings by giving our team a call. We’ll help you determine if your business is eligible for a Second Opinion, and discuss the information we need from you to complete the review.

2. Comprehensive Assessment

Our team will conduct a thorough analysis of your information to identify any areas that could be improved. We will focus on uncovering opportunities that will save you time, reduce your current year’s tax bill, and enhance the overall business performance.

3. Second Opinion Report

Once our team has completed the review, we’ll create your Second Opinion Report which includes a detailed overview of our findings and recommended solutions. The report is yours, no strings attached!

4. Report Walkthrough

We will schedule a 1-hour meeting in-person, via Zoom, or on the phone to go over the Second Opinion Report with you. This is to ensure that you have a clear understanding of the report’s contents, all your questions are answered, and that you fully agree with the next steps to take.

Feeling lost? here are some related tags to help you navigate!

02

Bookkeeping & Payroll Services for Small Business Owners

Bookkeeping and payroll services gives your business an advantage to not only ensure accurate financial records and payments but also empower you to make informed decisions that lead to substantial cost savings.

Our team of experienced bookkeepers and accountants use innovative technology to streamline your financial processes and catch any mistakes before they become a problem.

This is how we help Small Business Owners through Bookkeeping:

- Fixed Fees for Bookkeeping & Payroll

- Cloud Bookkeeping Software

- Receipt Capturing connected to your software

- Dedicated Bookkeeping Expert

Moving away from traditional bookkeeping methods and transitioning to modern digital alternatives like accounting software will diminish the likelihood of inaccuracies which helps significantly ensure precision and currency of your financial records. Additionally, it frees up valuable time, enabling you to concentrate more on key business operations.

How do you know you are using traditional methods for your bookkeeping services:

- You keep collecting all your receipts in a shoebox.

- You manually record all of your business receipts and bank transactions.

- Your bookkeeper doesn’t provide regular updates on your business’s cash flow position.

- You have to follow up on your bookeeper or accountant for business reports.

Beyond mere convenience, cloud-based accounting holds significant importance for small businesses. It not only automates tasks but also ensures a high level of accuracy. This also streamlines financial management, offering small businesses the efficiency and precision they need to thrive in their industry.

Cloud Accounting Software we Use

Join countless small business owners in Brisbane who have already discovered the power of financial efficiency with leading cloud accounting software providers: Xero, QuickBooks Online, and MYOB – cloud accounting solutions that bring you streamlined finances, greater control, and informed decision-making.

Make a switch and book a discovery call with us today.

For small business owners in Brisbane, bookkeeping and accounting play crucial roles in effectively managing their finances. While these two functions might appear similar at first glance, there are distinct differences that set them apart.

Bookkeeping focuses on recording and organising financial data. Accounting is the interpretation and presentation of that data to business owners and investors.

Bookkeeping typically consists of:

- payroll

- invoicing

- receipts and bills

- recording business transactions

Accounting typically consists of:

- financial statements and reports

- budgets

- tax returns

- analysing business performance

Bookkeeping and accounting are two essential functions that play a crucial role in managing the financial aspects of a small business. By grasping the differences between these functions, small business owners can make informed decisions, maintain accurate records, and navigate the complexities of financial management more effectively.

03

Finance and Lending Solution for Small Business Owners

As a small business owner in Brisbane, obtaining finance approval can be a challenging process.

Finance and lending help businesses seize fast opportunities and grow. They offer to cover costs for opening new places, trying new markets, or adding products. This lets a business expand, improve, and do more than they could alone.

We can help you with:

- Low Doc Home Loan Solution for Small Business Owners

- Commercial Property & Warehouse Finance

- Asset & Equipment Finance for Small Business Owners

At Oyster Hub Finance, we are dedicated to helping small business owners in Brisbane like you find their pearls and lead you to success. Whether it’s looking for funds to cover expenses in opening new locations, exploring new markets, and expanding product offerings, Oysterhub stands ready to support you every step of the way. We don’t settle for surface-level assistance; instead, we dive deep into your specific requirements, challenges, and goals.

- Assessing Financial Needs: To better understand your financial landscape, our experts will conduct a thorough evaluation of your business and financial statements to determine the amount of funding needed and the best loan options for your specific circumstance.

- Gathering Documentation: We guide you through the process of gathering all the necessary documentation for the loan application. This includes financial statements, tax returns, bank statements, business plans, and any other supporting documents required by the lenders.

- Preparing a Strong Application: Our team assists in preparing a strong loan application that highlights your business’s strengths, financial stability, and growth potential. We ensure that all the relevant information is presented in a clear and compelling manner to enhance your chances of approval.

- Connecting with Lenders: As experienced finance brokers, we have established relationships with a network of lenders specialising in small business loans. We connect you with the right lenders, matching your needs and increasing your chances of securing favourable loan terms.

- Managing the Process: We act as your advocate throughout the loan application process, liaising with lenders, providing necessary updates, and addressing any queries or concerns. Our goal is to make the process as smooth and efficient as possible, saving you time and reducing the stress associated with loan applications.

By following these steps, clients are able to navigate through the loan application process, ensuring that they present a strong case to lenders and improve their chances of obtaining the financing they need towards greater success.

04

Tax Planning & Business Structures Setup for Small Business Owners

Choosing the right structure for your small business isn’t just about paperwork – it’s about maximizing your tax benefits. Our expert tax planning services guide you through the intricacies of different business structures, helping you identify the one that aligns perfectly with your unique situation.

If you find yourself burdened with high tax bills and haven’t reviewed your business structure, you might be missing out on valuable opportunities to minimise your tax affairs.

- Review of your current business structure to minimise tax

- Prepare Tax Planning report for your business

- Implementing Tax Strategies to minimise tax

- Review of Over PAID tax for previous financial years.

Our tax-saving strategies are backed by a promise that if we can’t deliver a refund or a better outcome moving forward, you won’t be charged for our service.

Getting To Know Your Business

By getting to know you and your business, we gain a deeper understanding of your current situation and long-term goals which allows us to develop a tailored plan to help you get where you want to be in the future! Let us walk you through:

- Comprehensive Analysis of your Tax Payments

- Thorough analysis of your past accounting practices

- Outline the steps to take during tax planning and implementation process

Identifying Your Business Goals And Growth Patterns

After our initial consultation, we conduct a comprehensive analysis to identify your future goals and growth patterns.

- Introductory analysis of your business objectives and strategies

- Understanding the factors that led to higher taxes in the past

- Develop a plan to recoup overpaid taxes

- Explore how legal structures can impact your tax liability

- Streamlining your business processes with automation

Prepare Tax Saving Strategies Reports

When we have identified your business and growth patterns, we will provide personalised tax strategy reports outlining your potential tax savings.

- Offer an impartial tax assessment to determine if you’re overpaying

- Provide actionable advice on how to reclaim excess taxes paid

- Proactive tax planning for the future

- In-depth analysis to clarify your situation

Implementing Tax Strategies

Following the delivery of your detailed tax savings report, we’ll schedule a meeting to ensure the smooth implementation of the recommended strategies.:

- Establishing target dates for executing the recommended strategies

- Schedule quarterly reviews to monitor progress

- Identify your financing needs for implementation

Your business structure isn’t just a label – it’s a key to unlocking valuable tax advantages. Through our expert tax planning, you can freely choose the structure that aligns with your goals and slashes your tax burden. Allow us to optimise your business structure for maximum tax benefits

Looking Under the Hood For OVERPAID TAX for Small Business Owners

If you are a start up or small business owner in Brisbane, with a turnover under $10m and you feel like you’ve overpaid taxes as a sole trader, company, or trust, our look under the hood solution will suit you.

Discover how our specialised tax services can help you unlock potential tax savings, optimise your business structure, and put more money back into your pocket.

- Review your ATO Lodgements: We will review your past 2 years ATO lodgments to understand why you have PAID high tax while yuer business cashflow may be low.

- Review your business Structure : Creating a budget for the business and implementing cost-saving measures. This also involves forecasting of the business’s cash flow so that the client can make informed financial decisions.

- Review of your Accounting & Bookeeping Process: Providing financial reports that will give insights into the business’s financial health. This may include balance sheets and financial statements.

- Virtual CFO Coaching for Small Business Owners. Providing financial reports that will give insights into the business’s financial health. This may include balance sheets and financial statements.

Need an expert wizard?

Come and have a chat with our friendly staff about your next big steps.

Get a SECOND rescue opinion for your Small Business for your previous year’s tax returns if you have PAID High Tax Bills.

We find that most business owners are heading toward a business crisis if they identify the following in your business.

Drowning In Paperwork

Low Business Cashflow

Paying High Tax Bills

Accountant is working like a sloth

IMPACT

Is Your Business Creating an IMPACT ?

Small business owners constitutes to approximately 94% of all businesses in Australia. As a business owner, are you making a positive making an IMPACT on the community, for your loved ones, or for yourself? What’s your legacy?

At Oyster Hub, our co-founders share a close working relationship with small business owners like yourself. Our mission is to help you create a business that brings joy, makes a positive impact, and leaves a lasting legacy. This is only possible if you are able to free yourself from from the day-to-day operational tasks. We are here to guide and support you in making a positive impact.

HOW TO WORK WITH US

How our Expert Accountants in Brisbane Work With Businesses

Oyster Hub takes pride in our team of expert accountants who are well-versed in the unique financial needs and challenges faced by small business owners in Brisbane. Our dedicated professionals understand your industry inside out, allowing us to provide tailored financial solutions that drive your business towards success.

Step 1:

Let us delve into your business needs and drive it to success. Schedule your discovery call now.

Step 2

Our team will conduct a thorough analysis to identify the gaps and potential areas for improvement.

Step 3

We are dedicated to providing the support you need so you can focus on doing what you love.

Why Choose Oyster Hub Wizard Accountants?

Managing your business’s finances can be overwhelming. With Oyster Hub, our award-winning accountants can provide expert aid and support to help you expand your business while maintaining complete tax compliance.

When you work with us, you are bound to get the best results. Whether you need help with bookkeeping, tax planning, or financial reporting, we’ve got you covered.

Oysterhub understands the importance of effective communication for successful business operations. Our team of experts is well-versed in cloud technology and proficient in utilising video conference platforms like Zoom and Microsoft Teams Meetings so you can you can connect and collaborate with us seamlessly from anywhere you are.

Oysterhub does not only take your small business and startup to new heights. We empower every small business owner to unlock their inner wizardry, enabling them to achieve their goals while making a profound social impact in their communities.

Moreover, we are proud advocates of the UN’s Sustainable Development Goals— inspiring our clients to amplifying their value and impact while driving positive change in the world.

Every businesses comes face to face with unique challenges when it comes to managing their accounting, bookkeeping, and finance needs. Our team of experienced professionals go beyond simply crunching numbers and tailor our services accordingly, allowing you to focus on what matters most: driving your small business towards unparalleled growth and scalability.

Sorting out payroll, taxes, and accounts can be an arduous task and could be better spent on completing new projects.

Countless clients have experienced a significant boost in revenue by redirecting their focus back into their core operations while allowing our skilled accountants to handle their financial matters. When you partner with us today, you will experience the difference our expertise can make for your business while providing additional support to fuel your business’s growth.

Clear financial records are the compass that guides successful businesses towards profitability. At Oyster Hub, our experienced accountants specialise in putting your financial records back on track.

In a world brimming with opportunities, we believe that every individual and business possesses a unique Pearl waiting to be discovered.

From managing budgets to optimising staff resources and closely monitoring your profit and loss, we provide the insights you need to drive your business forward.

Let Oyster Hub be your trusted guide in uncovering the hidden treasures within your business and life. We will focus on finding your pearl so you can enjoy doing the things you love the most.

In the aftermath of the COVID-19 pandemic, numerous business owners find themselves grappling with tax debts, causing significant financial strain. Our expert team is dedicated to surmounting these tax debt hurdles by implementing highly effective strategies tailored to your unique circumstances.

If you find yourself being hounded by the Australian Taxation Office (ATO) and have received distressing correspondence and notices, it is crucial to take immediate action.

Did you know that a staggering 80% of errors in small business finances are directly related to bookkeeping and tax? These mistakes can have a significant impact on your bottom line, leading to penalties, fines, and even potential legal consequences.

Running a business is no easy feat. At Oysterhub, we specialise in helping small businesses regain control of their financials— from struggling with bookkeeping, overdue tax lodgements, mounting ATO debts, and dwindling business cashflow. Our tailored solutions are designed to address your specific needs for regaining control and working towards resolving ATO tax debts.

Get in Touch With Our Team of Professional Tax Accountants Today

Our team is accessible in Penrith, Parramatta, and Blacktown, as well as surrounding areas. We offer a wide range of services with the intention of adding value to your finances.

Our expert team is well-versed in small business concerns and can provide customised support that aligns perfectly with your business goals. From strategic financial planning to tax optimisation and cash flow management, we got you covered.

Contact us today to get started.

Lets Have A Chat

We focus on relationships with our clients, being available to answer any business, accounting, or tax questions you have.

"*" indicates required fields

What People Love About Us

I have never found a more passionate finance broker than Vik and his team at Oysterhub. We were about to lose our house when our business took a down shift. Vik saved us from getting a finance deal approved when banks shut the door at us. It's great to work with people who actually care about people not just profits.

I have never seen someone more passionate tax accountant than Adarsh about wanting to help people save time on their menial processes - makes me wonder the experiences in business he has gone through but I'm not complaining I am thankful for it. He is the only tax accountant who has helped me save an extra 8-10 hours per week on lazy accountant tasks and facilitate in enabling me to put these tasks to more productive areas.

- See More