Why Are BAS Due Dates Crucial for Your Business Reporting?

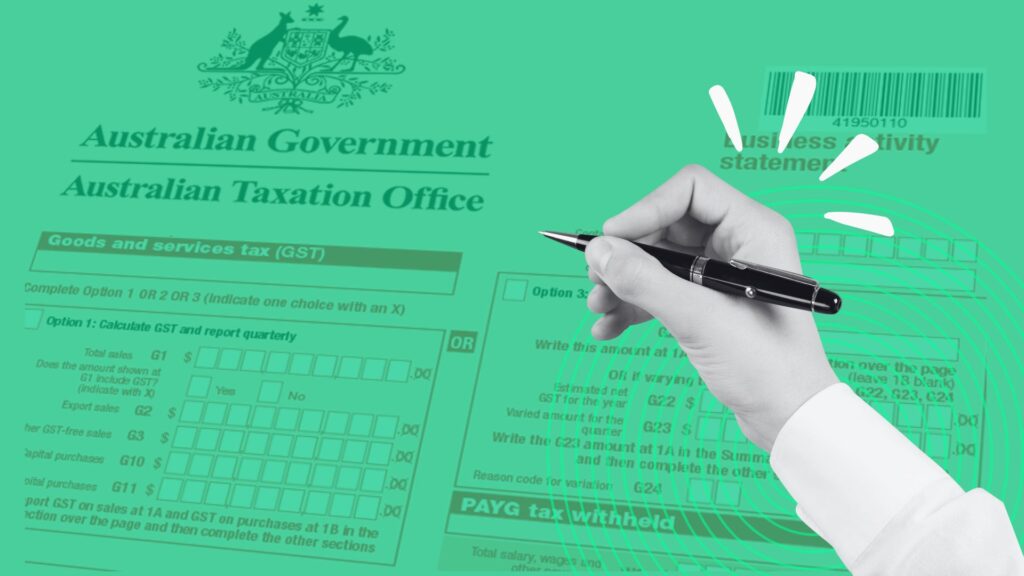

BAS needs to be lodged for businesses with a turnover more than $75,000 each year, it is compulsory you have to be GST registered under the law. BAS stands for Business Activity Statement. It is a form that needs to be submitted to the ATO key dates key dates if your business is registered for GST.

Your BAS statement lets the ATO know how much tax you need to pay or be refunded. Submitting it on time ensures that businesses meet ATO requirements, prevent penalties, and maintain a steady cash flow. Failing to meet a BAS deadline can result in serious consequences such as failure to lodge penalties, interest charges, and potential audits.

This article provides a comprehensive guide on BAS lodgement, including deadlines and common errors to avoid that can cause high ATO GST Payments. Avoid these things that trigger ATO Audits and fraud investigations.

Types of BAS Lodgements

Businesses have several options for BAS lodgements based on their turnover and specific requirements:

- Quarterly BAS Lodgement: This is the best choice for most small businesses.

- Monthly BAS Lodgement: Larger businesses or those with higher GST turnover may find this option more suitable.

- Annual BAS Lodgement: A viable alternative for businesses with lower turnover.

Being aware of these choices will ensure that your business remains compliant and steers clear of unnecessary complications.

Understanding BAS and Submission Dates

Lodging your Business Activity Statement (BAS) with the Australian Taxation Office (ATO) is a crucial responsibility for businesses registered for GST. A BAS agent can assist with this process. This process involves reporting and paying GST, PAYG instalments, PAYG withholding tax, and other tax obligations. Understanding the available lodgement methods can help streamline this task and ensure compliance.

How to Lodge BAS

Here are the different ways you can lodge your BAS:

1. Online Lodgement

The easiest method to submit your BAS is by using the ATO’s online services. There are three choices available for lodging online.:

- ATO Online Services: You can submit your statement directly through the ATO Business Portal with your myGovID.

- Accounting Software Integration: Cloud accounting software like Xero, MYOB, and QuickBooks can streamline your BAS preparation with automatic generation and online lodgement directly with the ATO. Keep a copy of your BAS for your records.

- MyGov Account: Small business owners can also use their personal MyGov account linked to the ATO to lodge their BAS.

2. Through a Tax Agent

Engaging a registered tax agent like Oyster Hub Tax Accountants can be highly beneficial for businesses looking to manage their tax obligations effectively. Tax agents:

- Offer professional expertise in accurately preparing and lodging BAS.

- Often receive an extended deadline for lodgements, providing a buffer period that can be useful during busy times.

- Ensure all eligible credits are claimed, and reporting is accurate according to ATO standards and BAS agent guidelines. Consult the BAS guide for details.

3. By Mail

For those who prefer traditional methods or do not have reliable internet access, lodging by mail remains an option. This involves:

- Receiving Paper Forms: The ATO sends out paper forms if requested or required.

- Manual Completion: Manually filling out the BAS form based on your business records.

- Postage: Mailing the completed form back to the ATO using the provided address.

Each method has its advantages depending on your business needs and resources.

Accepted Payment Methods for BAS

When it comes to settling your Business Activity Statement (BAS) liabilities, the Australian Taxation Office (ATO) provides several convenient payment options. This ensures businesses can choose the method that best suits their financial management processes, including the 21st day due date. Here are the commonly used payment methods for BAS:

- Electronic Funds Transfer (EFT): Directly transfer funds from your bank account to the ATO using internet banking or phone banking services.

- Credit or Debit Card: Make payments using your credit or debit card through a secure online portal provided by the ATO.

- BPAY: Use BPAY to transfer funds electronically. Simply enter the biller code and reference number provided on your BAS form.

- Australia Post: Visit an Australia Post outlet to make payments in person using cash, cheque, EFTPOS, or credit card; you will need your payment reference number (PRN).

- Direct Debit: Schedule it to align with 21st day Bas requirements Set up a direct debit arrangement with the ATO to automatically deduct payments from your bank account on scheduled dates.

- Mail: Include your PRN for processing Send a cheque or money order along with your BAS form to the ATO via postal service.

Each method offers its own advantages, depending on your business’s cash flow and financial preferences. Ensuring timely and accurate payments is crucial for maintaining compliance and avoiding potential penalties.

What Are Quarterly BAS Due Dates Reporting

Eligibility for Quarterly Lodgement

Quarterly BAS lodgement is a common requirement for many small businesses. To determine if your business qualifies for quarterly BAS submissions, understanding the eligibility criteria is essential for maintaining compliance with key dates. Here are the primary factors:

- GST Turnover: Businesses with an annual GST turnover of less than $20 million generally qualify for quarterly lodgement. This threshold ensures that smaller businesses, which might have fewer transactions and resources, can manage their reporting more effectively.

- Business Type: Certain business types, such as those registered under a voluntary basis or those not required to be registered for GST, may also lodge their BAS quarterly. This flexibility accommodates various business structures and operational scales.

- ATO Notification: The ATO typically notifies eligible businesses about their quarterly lodgement status. If you receive such a notification, it indicates that you meet the necessary criteria.

- Compliance History: It can influence your eligibility for quarterly lodgements. Consistently meeting deadlines and maintaining accurate records helps in securing this option.

- Choice of Lodgement Frequency: Some businesses may opt-in for quarterly lodgements even if they qualify for monthly or annual submissions. The choice often depends on cash flow management preferences and administrative capacities.

Quarterly BAS Lodgement Dates

Once you’re aware that your business qualifies for quarterly lodgements, keeping track of the due dates is critical to avoid penalties and ensure smooth compliance with the ATO. Here are the standard due dates for each quarter:

| Quarter | Period | Due for Payment |

|---|---|---|

| 1 | July, August and September | 28 October |

| 2 | October, November and December | 28 February |

| 3 | January, February and March | 28 April |

| 4 | April, May and June | 28 July |

These dates are fixed unless they fall on a weekend or public holiday, in which case the due date shifts to the next business day.

Maintaining accurate records and setting reminders well ahead of these deadlines can significantly help in timely submissions. Utilising accounting software like Xero, QuickBooks, or MYOB can automate reminders and streamline the reporting process.

What Is the Monthly BAS Due Dates Reporting

Businesses in Australia that exceed an annual GST turnover of $20 million are obligated to submit their Business Activity Statements (BAS) on a monthly basis. Familiarity with the requirements is essential for effective tax management and adherence to regulations.

Firms with substantial operations find it beneficial to lodge their BAS monthly to track cash flow and avoid hefty tax payments every quarter. The deadline for submitting the BAS for businesses meeting the criteria is the 21st of the following month.

To illustrate, if your business files a May BAS, it must be submitted by the 21st of June.

Here are the monthly BAS due dates for monthly reporting.

| Month | Lodgement and Payment is Due |

|---|---|

| BAS due date July 2023 | 21 August |

| BAS due date August 2023 | 21 September |

| BAS due date September 2023 | 21 October is a key date |

| BAS due date October 2023 | 21 November |

| BAS due date November 2023 | Complete a BAS 21 December |

| BAS due date December 2023 | 21 January |

| BAS due date January 2024 | 21 February |

| BAS due date February 2024 | 21 March |

| BAS due date March 2024 | 21 April |

| BAS due date April 2024 | 21 May |

| BAS due date May 2024 | 21 June |

| BAS due date June 2024 | 21 July |

Annual BAS Obligations

It is vital for businesses that choose to lodge their BAS annually to be aware of the due date. The annual BAS deadline usually falls on October 28th and covers the financial year from July 1st to June 30th. Understanding the deadlines for lodgement is necessary to ensure compliance. Opting for this frequency can make reporting and compliance easier for eligible businesses.

Voluntary Registration for Annual Lodgement

Not all businesses are automatically eligible for annual BAS lodgement. Specific criteria must be met to qualify, making it essential to understand these requirements thoroughly.

Criteria for Eligibility:

- GST Turnover: Businesses must have a GST turnover under $75,000. This threshold ensures that only smaller enterprises, which generally have less complex financial activities, can take advantage of the simplified annual reporting.

- Voluntary Registration: Even if a business does not reach the mandatory GST registration turnover limit, it has the option to voluntarily register if it believes there are advantages in claiming GST credits or issuing GST invoices to customers.

- Other Requirements: Businesses must ensure they have no outstanding activity statements or tax obligations with the ATO. Being compliant with other tax-related responsibilities demonstrates good standing and reliability.

Consequences of Missing BAS Deadlines

Missing your BAS deadline can have serious financial and compliance consequences for your business. It’s important to understand these impacts so you can manage your cash flow effectively and meet the requirements of the Australian Taxation Office (ATO).

- Late Lodgement Penalty: If you don’t lodge your BAS on time, the ATO may charge you a penalty. The amount of this penalty depends on the size of your business and how long the lodgement is overdue, which could end up being quite costly.

- Late Payment Penalty: On top of the lodgement penalty, any tax amount that remains unpaid will be charged a general interest charge (GIC). This interest adds up daily and puts even more strain on your cash flow.

- Disrupted Financial Planning: The extra penalties and interest can throw off your financial plans. Money that was supposed to be used for growing your business or covering essential expenses might have to be used to pay off these unexpected costs instead.

By making sure you submit your BAS on time, you can avoid these direct financial consequences and maintain a good relationship with the ATO. It’s not just about money – it also shows that you’re running your business responsibly and following the rules set by regulatory authorities, ensuring timely lodgment and payment.

Avoiding Costly Mistakes in BAS Submission

Common mistakes in BAS submission can have significant financial repercussions, especially if you fail to lodge and pay on time. Understanding and avoiding these errors is crucial for maintaining compliance and optimising your business finances.

1. Not Claiming All Eligible GST Credits

Businesses frequently miss out on GST credit refunds by overlooking minor purchases or poor record-keeping. A strong system for tracking expenses ensures you claim everything you’re entitled to.

2. Ensuring Accurate Reporting of GST on a Cash Basis

Cash basis reporting requires recording GST at the time of payment, not invoicing. Accounting software designed for cash basis can simplify this to avoid errors and penalties from the ATO.

3. Incorrect Inclusion of GST on GST-Free Sales

Accidentally charging GST on GST-free goods like groceries or education can lead to overpayments and strain your cash flow. Familiarise yourself with the ATO’s GST-free classifications to avoid these errors. By prioritising accurate GST reporting, you’ll ensure compliant BAS submissions that benefit your business financially.

Key Takeaways:

Meeting BAS submission dates is critical for maintaining compliance with the ATO and ensuring your business’s financial stability by adhering to monthly activity statements. Missing the deadline can lead to significant consequences such as penalties, interest charges, and potential audits, which can disrupt cash flow and impede financial planning.

Implementing strategies to avoid missed deadlines, such as setting reminders to report GST monthly, is essential.

By prioritising these strategies, your business will not only stay compliant but also foster a healthier financial environment, enabling growth and stability.

If you need assistance with BAS due dates, lodgement processes, or error correction, contact Oyster Hub Accountants for a consultation. Whether you suspect you are overpaying BAS or simply need clarification on your obligations, reach out to us at (02) 9158 5444.

Frequently Asked Questions (FAQ)

A Business Activity Statement (BAS) is a form used by businesses in Australia to declare their taxable turnover to the ATO and to remit GST, PAYG withholding, and other taxes; businesses that report GST monthly must report their figures on time. Typically, it is required to be submitted on a quarterly basis. The BAS is a paperwork that must be filled out either once or up to twelve times a year, depending on the scale of your business. The ATO uses the information provided in your BAS to calculate your GST refund or payment. Moreover, it is used to determine business income tax (for those under the pay-as-you-go system), employee income tax, fringe benefits tax, luxury car tax, wine equalisation tax, and fuel tax credits.

A business activity statement reports on your:

- GST (Goods and service tax)

- PAYG instalments (Pay as you go)

- PAYG withholding tax

- Other taxes your business may be required to pay (like FBT, FTC).

The due date for lodge, pay your monthly business activity statements BAS, and GST turnover varies depending on the quarterly period. It is important to check the lodgement dates with the Australian Taxation Office to avoid penalties.

You can lodge your BAS online through the BAS guide ATO business portal. Make sure to do this before the lodgement and payment due date to remain compliant.

If your registered tax turnover exceeds $20 million, you are required to register for GST. It is crucial to report and pay your GST monthly once registered.

In the event that the deadlines for submitting or paying your BAS coincide with a weekend or public holiday, you have the option to submit and pay on the following business day without facing any penalties.

Yes, you can choose to report monthly and pay GST monthly and lodge a BAS more frequently if it aligns with your business needs. Just ensure you meet all the lodgment due dates accordingly.