Business Payroll Services

Tired of manually calculating payroll? Our proven methods will streamline your old payroll method and single touch payroll reporting.

Jump To

Accounting software we work with

HOW TO GET STARTED

Payroll Solutions for Small Business Owners, Contractors and Startups.

Oyster Hub tax accountants will provide you with automated cloud payroll solution that will meet all the ATO reporting requirements, automatically calculate super, tax, integrate systems with Single Touch Payroll systems and track your employee entitlements using cloud payroll systems that does it all and integrates your payroll systems through a cloud ecosystem.

- Automate employee pay calculations

- Better manage your workforce and costs

- Single touch payroll reporting

- Store everything you need online and complete payroll

- Stay compliant with Superannuation reproting

- Work With Us

How we can help streamline your business

We’ve walked in your shoes as small business owners, so we understand the unique hurdles you encounter on your path to growth

Books a FREE Discovery Call

Let’s chat about your business, your goals, and how we can help you achieve financial peace of mind.

Setup Busines Goals

We’ll work together to define clear, actionable financial goals that align with your vision for your business.

Find Your Pearl

We’ll dive deep into your finances to uncover hidden opportunities, tax savings, and strategies to maximize your profits your financial “pearl.”

For Small Business Owners we Provide Cloud Payroll Solutions .

Using Cloud Payroll Software is essential to comply with new regulations such as Single Touch Payroll. They also save time compared to manually calculating payroll. Forget spending hours entering timesheets, and calculating entitlements, leave and superannuation. Cloud Payroll Software such as Quickbooks Online allows the calculations to be completed within minutes.

01

Payroll Services using Quickbooks Online & XERO

Our comprehensive payroll services accurately calculate wages, taxes, superannuation, and other deductions, ensuring your employees are paid correctly. We take the stress out of payroll calculations so you can focus on other aspects of your business.

We offer efficient payroll services, including generating detailed, compliant payslips that your employees can easily understand. This helps ensure transparency and fosters trust within your team.

Our reliable payroll services manage superannuation contributions on your behalf, ensuring timely and accurate payments to your employees’ super funds, keeping you compliant with regulations.

We offer seamless integration with the ATO’s Single Touch Payroll system through our payroll services, reporting your payroll information accurately and in real-time. This simplifies your reporting process and ensures you meet ATO requirements.

Our comprehensive payroll services include preparing and lodging all necessary year-end payroll reports, including payment summaries and tax file declarations. We take the hassle out of year-end reporting, allowing you to focus on your business.

Our payroll services empower your employees to update their own personal details, submit leave requests, timesheets, and expenses, reducing your administrative workload and giving employees more control.

Cloud Payroll Solution that takes the frustration out by automating and tracking employee entitlements, superannuation obligations, Single Touch Payroll (STP) Reporting and having to linking all your systems together so you’re not being pulled in different directions by a bookkeeper and tax accountant.

Single Touch Payroll is an ATO initiative to streamline payroll reporting.

Put simply, Single Touch Payroll legislation requires employers to report wages, PAYG withholding, and superannuation information directly to the ATO using an online payroll system.

If you manage payroll for your business or a client, you will need to comply with Single Touch Payroll legislation:

1 – 19 Employees

You have until 1 July 2019 to get STP compliant.

20+ Employees

You should already be STP compliant.

Using cloud accounting softwares inbuilt with payroll functionality such as Quickbooks Online and Xero and MYOB will foster an integrated payroll solution powered by KeyPay does the maths and stays on top of ATO requirements. Helping to keep your payroll on time and compliant.

ATO Single Touch Payroll will be mandatory for all employers from 1 July 2019. With this date fast approaching, we encourage small businesses with employees to get digital-ready as soon as possible.

Oysterhub tax accountants can help you with the initial setup and training or you can choose to outsource the entire payroll.

We can even help connect you with a Single Touch Payroll (STP) expert.

02

FAQ Single Touch Payroll Compliance

Our tax planning process helps you proactively minimize your tax burden before your tax return is due

At Oyster Hub Tax Accountants, we get it. As small business owners ourselves, we understand your unique challenges. Let us handle your business tax returns, proactively minimizing your tax burden and maximizing deductions. We’ll navigate ATO compliance while you focus on growing your business.

03

Problems We Solve for Small Business Owners

Feeling overwhelmed by tax problems and frustrated with unresponsive accountants who offer no real guidance for your business growth? We understand.

Problems We Solve: Feeling Stuck with Overdue Accounting and Tax Obligations? Let Us Rescue Your Business. Our catch-up accounting service is designed specifically for small business owners who need to catchup on overdue work. We’ll handle your overdue filings, reconcile your accounts, and help you get compliant with the ATO, so you can focus on running your business.

How to Know You Need Rescue ?

- Your current Accountant & Bookkeeper is not responsive

- You have received failure to lodge ATO fines & penalties

- You have been issued with Director’s Penalty Notice (DPN)

- You have outstanding ATO Debt and Lodgements

- You are looking for business direction to scale

- You are behind on bookkeeping & paperwork

Problems We Solve: Concerned your tax return didn’t meet expectations? Is your accountant making you overpay taxes? Let our Award Winning Tax Accountants review your business tax returns, and potentially recover overpaid taxes. Get the peace of mind you deserve, knowing you’re maximising your tax savings.

How We Can Help with Second Opinion.

- Review Accounting & Bookkeeping

- Reverse Overpaid tax

- Create Tax Saving Plan

Problems We Solve: Is ATO debt holding your business back? Struggling with cash flow and worried about the impact on your family? Don’t let mounting tax debt cripple your business and personal life. Seek expert help today to regain control, manage your debt, and secure a brighter future.

- Negotiating Payment Arrangement.

- Remissions of Fines and Penalties

- Deal with ATO on Your Behalf

- Avoid Further Fines and Penalties

Learn More About ATO Payment Plan

Problems we Solve: Is your ATO debt stressing your business and impacting your family’s well-being? Don’t let it sink your livelihood. Talk to our tax experts today about ATO debt negotiation. We’ll help you regain control, improve cash flow, and protect your future.

- Small Business Restructuring (SBR)

- Negotiating ATO Debt on Your Behalf

- Tax Debt Finance Options

- Seek ATO Debt Release.

Learn More About Tax Debt Negotiating

We provide expert solutions for your toughest tax problems. From catch-up accounting to ATO debt negotiation, we’ll get your finances back on track and help your business thrive. Talk to Our Award Winning Accountants today. (02) 9158 5444 or Book a Call

#Oysterhub Meaning

The world is full of opportunities for you to maximise in order to live your life to the utmost extent alike to an Oyster! However finding out what the world has to offer that is specifically for you is a bit trickier and is your pearl and that is where we come into help you find your pearl together!

Feeling lost? here are some related tags to help you navigate!

Why Choose Oyster Hub Wizard Accountants ?

Managing your business’s finances can be overwhelming. With Oyster Hub, our award-winning accountants can provide expert aid and support to help you expand your business while maintaining complete tax compliance.

When you work with us, you are bound to get the best results. Whether you need help with bookkeeping, tax planning, or financial reporting, we’ve got you covered.

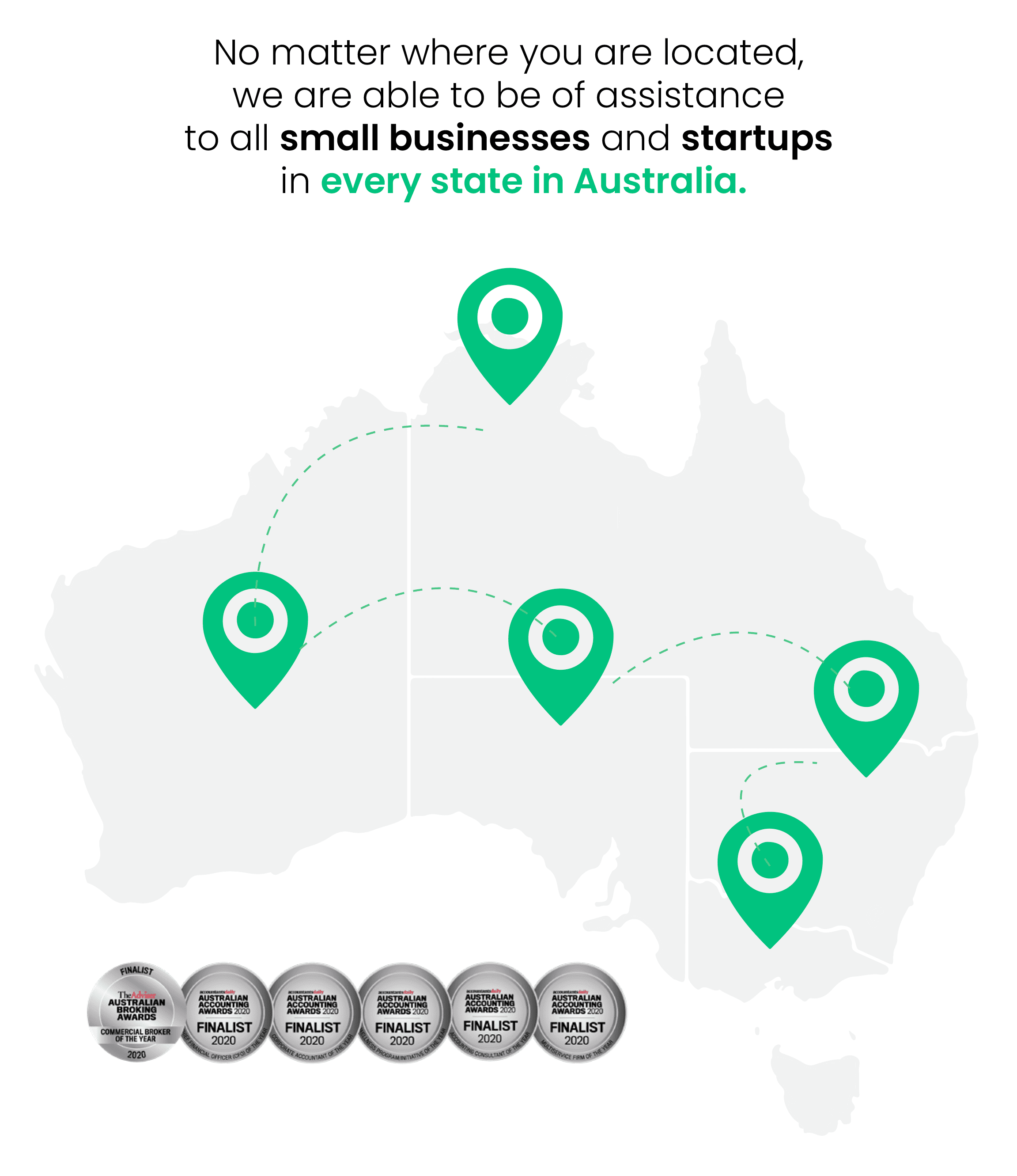

Oysterhub understands the importance of effective communication for successful business operations. Our team of experts is well-versed in cloud technology and proficient in utilizing video conference platforms like Zoom and Microsoft Teams Meetings so you can you can connect and collaborate with us seamlessly from anywhere you are.

Oysterhub does not only take your small business and startup to new heights. We empower every small business owner to unlock their inner wizardry, enabling them to achieve their goals while making a profound social impact in their communities.

Moreover, we are proud advocates of the UN’s Sustainable Development Goals— inspiring our clients to amplifying their value and impact while driving positive change in the world.

Every businesses comes face to face with unique challenges when it comes to managing their accounting, bookkeeping, and finance needs. Our team of experienced professionals go beyond simply crunching numbers and tailor our services accordingly, allowing you to focus on what matters most: driving your small business towards unparalleled growth and scalability.

Sorting out payroll, taxes, and accounts can be an arduous task and could be better spent on completing new projects.

Countless clients have experienced a significant boost in revenue by redirecting their focus back into their core operations while allowing our skilled accountants to handle their financial matters. When you partner with us today, you will experience the difference our expertise can make for your business while providing additional support to fuel your business’s growth.

Clear financial records are the compass that guides successful businesses towards profitability. At Oyster Hub, our experienced accountants specialise in putting your financial records back on track.

In a world brimming with opportunities, we believe that every individual and business possesses a unique Pearl waiting to be discovered.

From managing budgets to optimizing staff resources and closely monitoring your profit and loss, we provide the insights you need to drive your business forward.

Let Oyster Hub be your trusted guide in uncovering the hidden treasures within your business and life. We will focus on finding your pearl so you can enjoy doing the things you love the most.

In the aftermath of the COVID-19 pandemic, numerous business owners find themselves grappling with tax debts, causing significant financial strain. Our expert team is dedicated to surmounting these tax debt hurdles by implementing highly effective strategies tailored to your unique circumstances.

If you find yourself being hounded by the Australian Taxation Office (ATO) and have received distressing correspondence and notices, it is crucial to take immediate action.

Did you know that a staggering 80% of errors in small business finances are directly related to bookkeeping and tax? These mistakes can have a significant impact on your bottom line, leading to penalties, fines, and even potential legal consequences.

Running a business is no easy feat. At Oysterhub, we specialize in helping small businesses regain control of their financials— from struggling with bookkeeping, overdue tax lodgements, mounting ATO debts, and dwindling business cashflow. Our tailored solutions are designed to address your specific needs for regaining control and working towards resolving ATO tax debts.

Get a SECOND rescue opinion for your Small Business for your previous year’s tax returns if you have PAID High Tax Bills.

We find that most business owners are heading toward a business crisis if they identify the following in your business.

Drowning In Paperwork

Low Business Cashflow

Paying High Tax Bills

Accountant is working like a sloth

Need an expert wizard?

Come and have a chat with our friendly staff about your next big steps.

Feeling lost? here are some related tags to help you navigate!

GET TO KNOW US MORE

Learn more about our Award Winning Service

Your business is a journey; create an impact and build a business that has a purpose to make a difference to your family, community, and yourself. We have put together everything you need to know about how we create an impact at Oyster Hub with ‘Your Journey with Oyster Hub Guide.’ Download the PDF and learn more about how you can create an impact in your business

Previous

Small Business Tax Accounting

Next

What People Love About Us

I have never found a more passionate finance broker than Vik and his team at Oysterhub. We were about to lose our house when our business took a down shift. Vik saved us from getting a finance deal approved when banks shut the door at us. It's great to work with people who actually care about people not just profits.

I have never seen someone more passionate tax accountant than Adarsh about wanting to help people save time on their menial processes - makes me wonder the experiences in business he has gone through but I'm not complaining I am thankful for it. He is the only tax accountant who has helped me save an extra 8-10 hours per week on lazy accountant tasks and facilitate in enabling me to put these tasks to more productive areas.

- See More