Business Tax Returns

Proactive Tax Accounting and Annual Business Tax Returns for Small Business Owners.

Jump To

Accounting software we work with

HOW TO GET STARTED

Looking for a Tax Accountant for Business Tax Returns?

Our expert tax accountants specialise in preparing and optimizing business tax returns. We’ll help you navigate the complexities of your business tax return to ensure you’re maximising deductions, minimising your tax liability, and staying compliant with ATO regulations.

- Work With Us

How we can help streamline your business

We’ve walked in your shoes as small business owners, so we understand the unique hurdles you encounter on your path to growth

Books a FREE Discovery Call

Let’s chat about your business, your goals, and how we can help you achieve financial peace of mind.

Setup Busines Goals

We’ll work together to define clear, actionable financial goals that align with your vision for your business.

Find Your Pearl

We’ll dive deep into your finances to uncover hidden opportunities, tax savings, and strategies to maximize your profits your financial “pearl.”

For Small Businesses, We Provide Business Tax Return Services

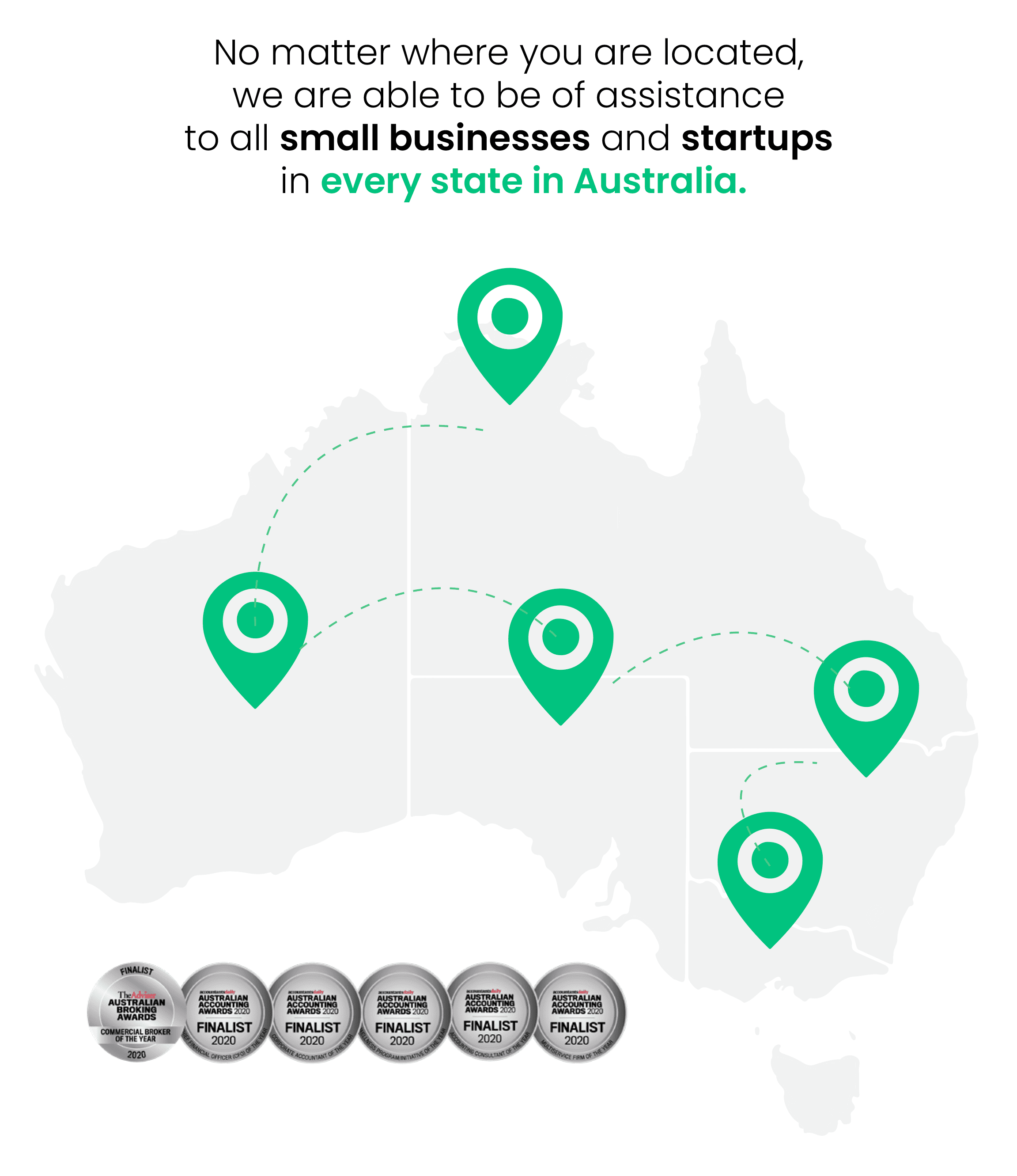

Our Sydney accountants at Oyster Hub provide a broad range of services to meet all the demands of every small business. You can select the level of involvement you want your accountant or bookkeeper to have before committing to our bespoke services. We provide options that range from basic account management to full-service consulting.

01

Annual Business Tax Returns

Our Tax Accountants can help you with the business end-of-the-year ATO compliance

We can help ensure your company’s financial health and tax compliance with our comprehensive Company Tax Returns service. Our tax accountants specialize in preparing and lodging business tax returns, ensuring your company tax return is accurate and optimized for your specific business needs. We maximise deductions and minimize your tax liability, so you can focus on running your business with confidence.

Trust Tax Returns can be complex, but we can help simplify the process. Our experienced tax accountants understand the intricacies of trust taxation and will ensure accurate income distribution and beneficiary reporting. We’ll optimize your trust’s tax position, making your business tax returns a seamless experience.

We can help streamline the process of filing Group Company Tax Returns for your business. Our tax accountants handle the complexities of multiple company structures, ensuring accurate reporting and minimizing your overall tax burden. Our proactive approach identifies opportunities for consolidated tax savings across your group, optimizing your business tax returns for maximum benefit.

Directors and Partners Tax Returns demand personalized attention to your unique income sources and deduction opportunities. Our tax accountants are experienced in preparing business tax returns for individuals, ensuring you take advantage of all available deductions and minimize your tax liability. We’ll work closely with you to understand your specific needs and tailor our business tax return services accordingly.

Fringe Benefits Tax (FBT) Returns don’t have to be a headache. Our tax accountants specialize in preparing accurate FBT returns for businesses of all sizes. We’ll calculate your FBT liability and ensure compliance, minimizing your tax burden. With our expertise in business tax returns, you can rest assured that your FBT return is in good hands.

Self Managed Super Fund (SMSF) Tax Returns require specialized knowledge and attention to detail. Our tax accountants are SMSF experts and ensure accurate reporting of investment income, contributions, and pension payments. We optimize your fund’s tax position, helping you achieve your retirement goals and providing peace of mind for your business tax returns.

We can help simplify your business tax returns. Our tax accountants will optimize your deductions, ensure compliance, and provide proactive advice to minimize your tax liability. Let us handle the complexities while you focus on growing your business.

We don’t just wait for tax time. Our tax accountants will work with you year-round to develop proactive tax planning strategies that minimize your tax burden and maximize your deductions for your business tax returns.

We can help simplify complex tax structures with a bucket company, allowing for strategic tax planning to reduce your business tax return liability while optimizing your overall business structure. Our team will guide you through the entire process, ensuring a seamless setup and ongoing compliance for your business tax returns.

As your business grows, so do your tax planning needs. If you’re feeling the limitations of a sole trader structure, we can help you explore options like partnerships or companies. We’ll guide you through the legal and financial implications of each choice, ensuring a seamless transition that supports your long-term success with your business tax returns. Our team of tax experts understands the unique challenges faced by sole traders transitioning to new structures, and we’ll provide tailored tax planning advice to ensure informed decisions that align with your business goals.

02

Tax Planning for Small Business

Our tax planning process helps you proactively minimize your tax burden before your tax return is due

At Oyster Hub Tax Accountants, we get it. As small business owners ourselves, we understand your unique challenges. Let us handle your business tax returns, proactively minimizing your tax burden and maximizing deductions. We’ll navigate ATO compliance while you focus on growing your business.

03

Problems We Solve for Small Business Owners

Feeling overwhelmed by tax problems and frustrated with unresponsive accountants who offer no real guidance for your business growth? We understand.

Problems We Solve: Feeling Stuck with Overdue Accounting and Tax Obligations? Let Us Rescue Your Business. Our catch-up accounting service is designed specifically for small business owners who need to catchup on overdue work. We’ll handle your overdue filings, reconcile your accounts, and help you get compliant with the ATO, so you can focus on running your business.

How to Know You Need Rescue ?

- Your current Accountant & Bookkeeper is not responsive

- You have received failure to lodge ATO fines & penalties

- You have been issued with Director’s Penalty Notice (DPN)

- You have outstanding ATO Debt and Lodgements

- You are looking for business direction to scale

- You are behind on bookkeeping & paperwork

Problems We Solve: Concerned your tax return didn’t meet expectations? Is your accountant making you overpay taxes? Let our Award Winning Tax Accountants review your business tax returns, and potentially recover overpaid taxes. Get the peace of mind you deserve, knowing you’re maximising your tax savings.

How We Can Help with Second Opinion.

- Review Accounting & Bookkeeping

- Reverse Overpaid tax

- Create Tax Saving Plan

Problems We Solve: Is ATO debt holding your business back? Struggling with cash flow and worried about the impact on your family? Don’t let mounting tax debt cripple your business and personal life. Seek expert help today to regain control, manage your debt, and secure a brighter future.

- Negotiating Payment Arrangement.

- Remissions of Fines and Penalties

- Deal with ATO on Your Behalf

- Avoid Further Fines and Penalties

Learn More About ATO Payment Plan

Problems we Solve: Is your ATO debt stressing your business and impacting your family’s well-being? Don’t let it sink your livelihood. Talk to our tax experts today about ATO debt negotiation. We’ll help you regain control, improve cash flow, and protect your future.

- Small Business Restructuring (SBR)

- Negotiating ATO Debt on Your Behalf

- Tax Debt Finance Options

- Seek ATO Debt Release.

Learn More About Tax Debt Negotiating

We provide expert solutions for your toughest tax problems. From catch-up accounting to ATO debt negotiation, we’ll get your finances back on track and help your business thrive. Talk to Our Award Winning Accountants today. (02) 9158 5444 or Book a Call

#Oysterhub Meaning

The world is full of opportunities for you to maximise in order to live your life to the utmost extent alike to an Oyster! However finding out what the world has to offer that is specifically for you is a bit trickier and is your pearl and that is where we come into help you find your pearl together!

Feeling lost? here are some related tags to help you navigate!

Why Choose Oyster Hub Wizard Accountants ?

Managing your business’s finances can be overwhelming. With Oyster Hub, our award-winning accountants can provide expert aid and support to help you expand your business while maintaining complete tax compliance.

When you work with us, you are bound to get the best results. Whether you need help with bookkeeping, tax planning, or financial reporting, we’ve got you covered.

Oysterhub understands the importance of effective communication for successful business operations. Our team of experts is well-versed in cloud technology and proficient in utilizing video conference platforms like Zoom and Microsoft Teams Meetings so you can you can connect and collaborate with us seamlessly from anywhere you are.

Oysterhub does not only take your small business and startup to new heights. We empower every small business owner to unlock their inner wizardry, enabling them to achieve their goals while making a profound social impact in their communities.

Moreover, we are proud advocates of the UN’s Sustainable Development Goals— inspiring our clients to amplifying their value and impact while driving positive change in the world.

Every businesses comes face to face with unique challenges when it comes to managing their accounting, bookkeeping, and finance needs. Our team of experienced professionals go beyond simply crunching numbers and tailor our services accordingly, allowing you to focus on what matters most: driving your small business towards unparalleled growth and scalability.

Sorting out payroll, taxes, and accounts can be an arduous task and could be better spent on completing new projects.

Countless clients have experienced a significant boost in revenue by redirecting their focus back into their core operations while allowing our skilled accountants to handle their financial matters. When you partner with us today, you will experience the difference our expertise can make for your business while providing additional support to fuel your business’s growth.

Clear financial records are the compass that guides successful businesses towards profitability. At Oyster Hub, our experienced accountants specialise in putting your financial records back on track.

In a world brimming with opportunities, we believe that every individual and business possesses a unique Pearl waiting to be discovered.

From managing budgets to optimizing staff resources and closely monitoring your profit and loss, we provide the insights you need to drive your business forward.

Let Oyster Hub be your trusted guide in uncovering the hidden treasures within your business and life. We will focus on finding your pearl so you can enjoy doing the things you love the most.

In the aftermath of the COVID-19 pandemic, numerous business owners find themselves grappling with tax debts, causing significant financial strain. Our expert team is dedicated to surmounting these tax debt hurdles by implementing highly effective strategies tailored to your unique circumstances.

If you find yourself being hounded by the Australian Taxation Office (ATO) and have received distressing correspondence and notices, it is crucial to take immediate action.

Did you know that a staggering 80% of errors in small business finances are directly related to bookkeeping and tax? These mistakes can have a significant impact on your bottom line, leading to penalties, fines, and even potential legal consequences.

Running a business is no easy feat. At Oysterhub, we specialize in helping small businesses regain control of their financials— from struggling with bookkeeping, overdue tax lodgements, mounting ATO debts, and dwindling business cashflow. Our tailored solutions are designed to address your specific needs for regaining control and working towards resolving ATO tax debts.

Get a SECOND rescue opinion for your Small Business for your previous year’s tax returns if you have PAID High Tax Bills.

We find that most business owners are heading toward a business crisis if they identify the following in your business.

Drowning In Paperwork

Low Business Cashflow

Paying High Tax Bills

Accountant is working like a sloth

Need an expert wizard?

Come and have a chat with our friendly staff about your next big steps.

Feeling lost? here are some related tags to help you navigate!

GET TO KNOW US MORE

Learn more about our Award Winning Service

Your business is a journey; create an impact and build a business that has a purpose to make a difference to your family, community, and yourself. We have put together everything you need to know about how we create an impact at Oyster Hub with ‘Your Journey with Oyster Hub Guide.’ Download the PDF and learn more about how you can create an impact in your business

Previous

Small Business Tax Accounting

Next

What People Love About Us

I have never found a more passionate finance broker than Vik and his team at Oysterhub. We were about to lose our house when our business took a down shift. Vik saved us from getting a finance deal approved when banks shut the door at us. It's great to work with people who actually care about people not just profits.

I have never seen someone more passionate tax accountant than Adarsh about wanting to help people save time on their menial processes - makes me wonder the experiences in business he has gone through but I'm not complaining I am thankful for it. He is the only tax accountant who has helped me save an extra 8-10 hours per week on lazy accountant tasks and facilitate in enabling me to put these tasks to more productive areas.

- See More