Small Business Accountants in Blacktown

Jump To

Why Hire a Tax Accountant in Blacktown?

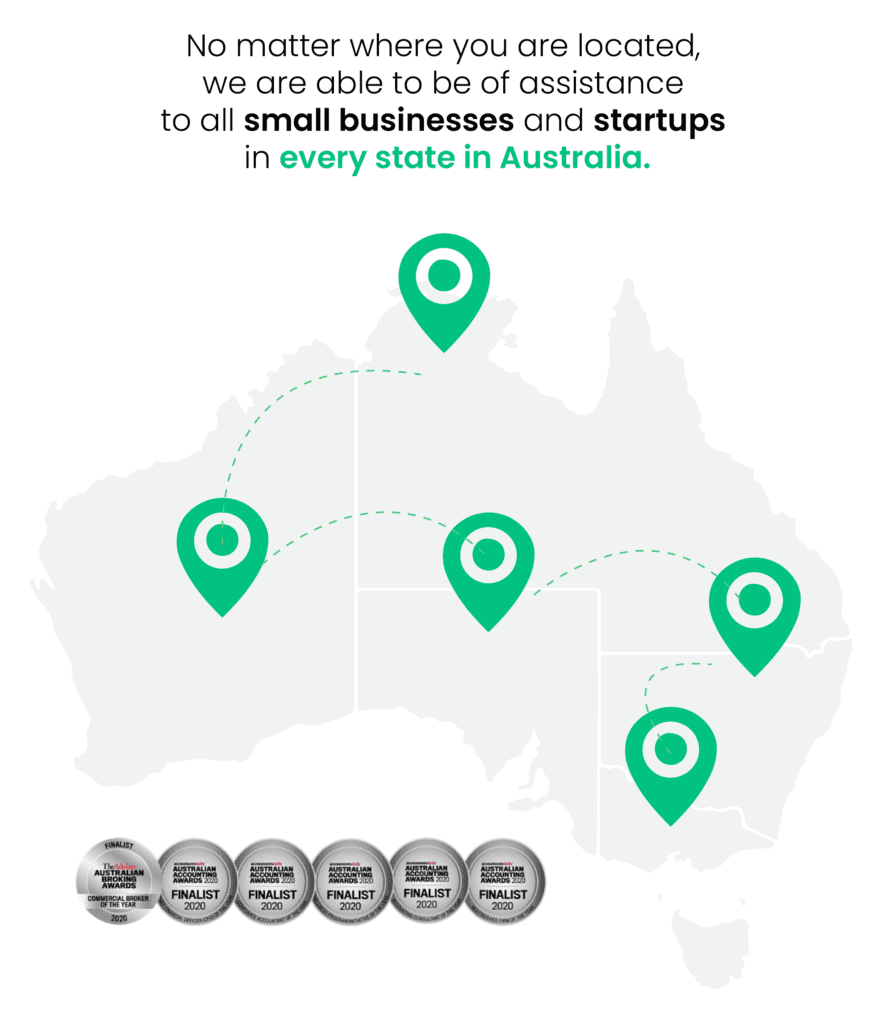

Oyster Hub is an award-winning accounting firm offering ONE-stop solution to small business owners in Blacktown with businesses around Blacktown and understand small business challenges, providing complete business accounting, tax agent services, bookkeeping and self-employed finance solutions. Get in touch and learn Oyster Hub Difference.

How Our Accountants Help Small Business Owners in Blacktown:

- Your Accountants Not Being Responsive

- Timely and Easy ATO Compliance

- Rescue Tax Accounting

- Minimise Tax Liabilities

- Personalised Business Support

- Work With Us for registered Tax and Accounting Solutions

Are you Looking for a Blacktown Accountant?

Meet Adarsh, Co-Founder of Oyster Hub and Award Winning Accountant and CFO. He has a strong passion for working with start-ups and small business owners, committed to helping them reach their business, financial, and family goals.

Adarsh has been recognised in various industry publications and events for his focus on helping business owners find purpose and balance while managing their businesses.

In a recent campaign by Intuit QuickBooks, he was named “The Wizard of Accounting.”

There is a wizard in every business and we empower small businesses to make a better business to create a difference.

HOW WE CAN HELP

How We Can Help with Your Small Business in Blacktown

Oyster Hub goes beyond traditional accounting services by offering cloud accounting software solutions that enhance our client’s financial success. Our dedicated team of accountants provides personalised attention and expert guidance, particularly during complicated situations, ensuring seamless integration and utilisation of the cloud accounting software.

Unlock your financial potential with these Cloud Accounting Software Solutions

Are you a start-up business struggling to keep up with your accounting and bookkeeping?

Explore How We Help Small Business Owners Scale Their Business

Small business owners often find themselves bogged down by admin tasks, which diverts their attention from growth-focused activities like growing your business. Oyster Hub is an award-winning accounting firm with a perfect one-stop solution for small business owners in Blacktown.

Whether you’re a start-up, a growing business, or a well-established company, our team of specialists is dedicated to providing unparalleled support and expert advice tailored specifically to your needs.

Are you overwhelmed with the amount of paperwork stacking up on your desk? Do you feel like you’re falling behind or getting chased by ATO for overdue lodgments?

Rescue Catchup

Accounting For Small Business Owners

Rescue Catchup Accounting for small business owners in Blacktown will help you get your accounting and taxation obligations back on track.

Start your journey to tax savings by giving our team a call. We’ll help you determine if your business is eligible for a Second Opinion, and discuss the information we need from you to complete the review.

1. Make A Call

Start your journey to tax savings by giving our team a call. We’ll help you determine if your business is eligible for a Second Opinion, and discuss the information we need from you to complete the review.

2. Comprehensive Assessment

Our team will conduct a thorough analysis of your information to identify any areas that could be improved. We will focus on uncovering opportunities that will save you time, reduce your current year’s tax bill, and enhance the overall business performance.

3. Second Opinion Report

Once our team has completed the review, we’ll create your Second Opinion Report which includes a detailed overview of our findings and recommended solutions. The report is yours, no strings attached!

Oyster Hub is a cloud based accounting firm similar to Carter’s Tax Advisory helping business owners in Blacktown with rescue accounting related work.

01

Accounting & Taxation Services for Small Business Owners

Proper accounting and taxation is a strong base for small businesses. It helps them watch over all their money matters carefully, from their profits to their expenses.

Our comprehensive bookkeeping and accounting services are designed to keep you on top of your financial records. Let us help you lay the groundwork for lasting success.

- Annual Company Tax Returns & Financial for Small Business Owners

- Preparation of consolidated reporting for Group Entities

- Lodgement of Fringe benefits tax (FBT) reports

- Lodgement of Small Business Owners Business Activity Statements

- Lodgement of Contractor Reports (TPAR) for Small Business Owners

Our Tax Refund Review Process is designed to help you navigate the complexities of tax filings, identify potential opportunities for refunds, and ensure compliance with the latest tax regulations.

1. Make A Call

Start your journey to tax savings by giving our team a call. We’ll help you determine if your business is eligible for a Second Opinion, and discuss the information we need from you to complete the review.

2. Comprehensive Assessment

Our team will conduct a thorough analysis of your information to identify any areas that could be improved. We will focus on uncovering opportunities that will save you time, reduce your current year’s tax bill, and enhance the overall business performance.

3. Second Opinion Report

Once our team has completed the review, we’ll create your Second Opinion Report which includes a detailed overview of our findings and recommended solutions. The report is yours, no strings attached!

4. Report Walkthrough

We will schedule a 1-hour meeting in-person, via Zoom, or on the phone to go over the Second Opinion Report with you. This is to ensure that you have a clear understanding of the report’s contents, all your questions are answered, and that you fully agree with the next steps to take.

Feeling lost? here are some related tags to help you navigate!

02

Bookkeeping & Payroll Services for Small Business Owners

Bookkeeping and payroll services gives your business an advantage to not only ensure accurate financial records and payments but also empower you to make informed decisions that lead to substantial cost savings.

Our team of experienced bookkeepers and accountants use innovative technology to streamline your financial processes and catch any mistakes before they become a problem.

How we help Small Business Owners through Bookkeeping and other tax services

- Fixed Fees for Bookkeeping & Payroll

- Cloud Bookkeeping Software

- Receipt Capturing connected to your software

- Dedicated Bookkeeping Expert

Moving away from traditional bookkeeping methods and transitioning to modern digital alternatives like accounting software will diminish the likelihood of inaccuracies which helps significantly ensure precision and currency of your financial records. Additionally, it frees up valuable time, enabling you to concentrate more on key business operations.

How do you know you are using traditional methods for your bookkeeping services:

- You keep collecting all your receipts in a shoebox.

- You manually record all of your business receipts and bank transactions.

- Your bookkeeper doesn’t provide regular updates on your business’s cash flow position.

- You have to follow up on your bookkeeper or accountant for business reports to take advantage of our financial services.

Beyond mere convenience, cloud-based accounting holds significant importance for small businesses. It not only automates tasks but also ensures a high level of accuracy. This also streamlines financial management, offering small businesses the efficiency and precision they need to thrive in their industry.

Cloud Accounting Software we Use for tax purposes.

Join countless small business owners in Blacktown who have already discovered the power of financial efficiency with leading cloud accounting software providers: Xero, QuickBooks Online, and MYOB – cloud accounting solutions that bring you streamlined finances, greater control, and informed decision-making.

Make a switch and book a discovery call with us today.

03

Finance and Lending Solution for Small Business Owners

As a small business owner in Blacktown, obtaining finance approval can be a challenging process.

Finance and lending help businesses seize fast opportunities and grow. They offer to cover costs for opening new places, trying new markets, or adding products. This lets a business expand, improve, and do more than they could alone.

We can help you with:

- Low Doc Home Loan Solution for Small Business Owners

- Commercial Property & Warehouse Finance

- Asset & Equipment Finance for Small Business Owners

At Oyster Hub Finance, we are dedicated to helping small business owners in Blacktown like you find their pearls and lead you to success. Whether it’s looking for funds to cover expenses in opening new locations, exploring new markets, and expanding product offerings, Oysterhub stands ready to support you every step of the way. We don’t settle for surface-level assistance; instead, we dive deep into your specific requirements, challenges, and goals.

- Assessing Financial Needs: To better understand your financial landscape, our experts will conduct a thorough evaluation of your business and financial statements to determine the amount of funding needed and the best loan options for your specific circumstance.

- Gathering Documentation: We guide you through the process of gathering all the necessary documentation for the loan application. This includes financial statements, tax returns, bank statements, business plans, and any other supporting documents required by the lenders.

- Preparing a Strong Application: Our team assists in preparing a strong loan application that highlights your business’s strengths, financial stability, and growth potential. We ensure that all the relevant information is presented in a clear and compelling manner to enhance your chances of approval.

- Connecting with Lenders: As experienced finance brokers, we have established relationships with a network of lenders specialising in small business loans. We connect you with the right lenders, matching your needs and increasing your chances of securing favourable loan terms.

- Managing the Process: We act as your advocate throughout the loan application process, liaising with lenders, providing necessary updates, and addressing any queries or concerns. Our goal is to make the process as smooth and efficient as possible, saving you time and reducing the stress associated with loan applications.

By following these steps, clients are able to navigate through the loan application process, ensuring that they present a strong case to lenders and improve their chances of obtaining the financing they need towards greater success.

04

Tax Planning & Business Structures Setup for Small Business Owners

Choosing the right structure for your small business isn’t just about paperwork – it’s about maximizing your tax benefits. Our expert tax planning services guide you through the intricacies of different business structures, helping you identify the one that aligns perfectly with your unique situation.

If you find yourself burdened with high tax bills and haven’t reviewed your business structure, you might be missing out on valuable opportunities to minimise your tax affairs.

- Review of your current business structure to minimise tax

- Prepare Tax Planning report for your business

- Implementing Tax Strategies to minimise tax

- Review of Over PAID tax for previous financial years.

Our tax-saving strategies are backed by a promise that if we can’t deliver a refund or a better outcome moving forward, you won’t be charged for our service.

Getting To Know Your Business with Our Range of tax accounting Services

By getting to know you and your business, we gain a deeper understanding of your current situation and long-term goals which allows us to develop a tailored plan to help you get where you want to be in the future! Let us walk you through:

- Comprehensive Analysis of your Tax Payments

- Thorough analysis of your past accounting practices

- Outline the steps to take during tax planning and implementation process

Identifying Your Business Goals And Growth Patterns

After our initial consultation, we conduct a comprehensive analysis to identify your future goals and growth patterns.

- Introductory analysis of your business objectives and strategies

- Understanding the factors that led to higher taxes in the past

- Develop a plan to recoup overpaid taxes

- Explore how legal structures can impact your tax liability

- Streamlining your business processes with automation

Prepare Tax Saving Strategies Reports

When we have identified your business and growth patterns, we will provide personalised tax strategy reports outlining your potential tax savings.

- Offer an impartial tax assessment to determine if you’re overpaying

- Provide actionable advice on how to reclaim excess taxes paid

- Proactive tax planning for the future

- In-depth analysis to clarify your situation

Implementing Tax Strategies

Following the delivery of your detailed tax savings report, we’ll schedule a meeting to ensure the smooth implementation of the recommended strategies:

- Establishing target dates for executing the recommended strategies

- Schedule quarterly reviews to monitor progress

- Identify your financing needs for implementation

Your business structure isn’t just a label – it’s a key to unlocking valuable tax advantages. Through our expert tax planning, you can freely choose the structure that aligns with your goals and slashes your tax burden. Allow us to optimise your business structure for maximum tax benefits

Need an expert wizard?

Come and have a chat with our friendly staff about your next big steps.

RESCUE EXPERTS

How to Know That You Need a Rescue Accountant

Get a SECOND rescue opinion for your Small Business for your previous year’s tax returns if you have PAID High Tax Bills.

We find that most business owners are heading toward a business crisis if they identify the following in your business.

Drowning In Paperwork

Low Business Cashflow

Paying High Tax Bills

Accountant is working like a sloth

Frequently Asked Questions

Oyster Hub Common Question regarding our accounting services in Blacktown NSW.

Oyster Hub provides a wide range of services in Blacktown, including accounting and tax services, financial reporting, and business advice tailored to the needs of small businesses.

Choosing professional tax accountants ensures effective tax planning, accurate financial reporting, and compliance with regulations. Our team of tax accountants can provide expert tax advice and help maximize your tax deductions.

Yes, our accountants in Blacktown NSW specialize in both business and personal income tax, providing services to individuals and ensuring thorough preparation and filing of individual tax returns.

A registered tax agent from Oyster Hub can assist with both strategic tax planning and compliance, providing professional services that help your business minimize tax liabilities and focus on growing your business.

Oyster Hub is recognized among the best accountants in Blacktown due to our commitment to providing expert accounting services tailored to the unique needs of each client, backed by a team of Award Winning Accountants

Yes, we offer a range of advisory services in Blacktown, assisting businesses with strategic planning, cash flow management, and other financial services to ensure a successful business operation.

Oyster Hub works with a variety of businesses, including small businesses, sole traders, and more. We provide services tailored to each business’s specific needs, allowing owners to focus on what matters most to them.

Oyster Hub is conveniently located in Blacktown and our professional accountants are ready to assist you with all your accounting and tax needs, ensuring your business operates smoothly and efficiently.

Yes, our team of business tax accountants is highly experienced in handling a wide range of complex tax issues, providing expert tax advice, compliance assistance, and ensuring the best tax outcomes for your business.

Our qualified accountants offer significant benefits to small businesses, including accurate financial reporting, strategic business advice, and professional accounting services that help businesses succeed and grow in Sydney and surrounding areas.

Why Choose Oyster Hub Wizard Accountants?

Managing your business’s finances can be overwhelming. With Oyster Hub, our award-winning accountants can provide expert aid and support to help you expand your business while maintaining complete tax compliance.

When you work with us, you are bound to get the best results. Whether you need help with bookkeeping, tax planning, or financial reporting, we’ve got you covered.

Oysterhub understands the importance of effective communication for successful business operations. Our team of experts is well-versed in cloud technology and proficient in utilising video conference platforms like Zoom and Microsoft Teams Meetings so you can you can connect and collaborate with us seamlessly from anywhere you are.

Oysterhub does not only take your small business and startup to new heights. We empower every small business owner to unlock their inner wizardry, enabling them to achieve their goals while making a profound social impact in their communities.

Moreover, we are proud advocates of the UN’s Sustainable Development Goals— inspiring our clients to amplifying their value and impact while driving positive change in the world.

Every businesses comes face to face with unique challenges when it comes to managing their accounting, bookkeeping, and finance needs. Our team of experienced professionals go beyond simply crunching numbers and tailor our services accordingly, allowing you to focus on what matters most: driving your small business towards unparalleled growth and scalability.

Sorting out payroll, taxes, and accounts can be an arduous task and could be better spent on completing new projects.

Countless clients have experienced a significant boost in revenue by redirecting their focus back into their core operations while allowing our skilled accountants to handle their financial matters. When you partner with us today, you will experience the difference our expertise can make for your business while providing additional support to fuel your business’s growth.

Clear financial records are the compass that guides successful businesses towards profitability. At Oyster Hub, our experienced accountants specialise in putting your financial records back on track.

In a world brimming with opportunities, we believe that every individual and business possesses a unique Pearl waiting to be discovered.

From managing budgets to optimising staff resources and closely monitoring your profit and loss, we provide the insights you need to drive your business forward.

Let Oyster Hub be your trusted guide in uncovering the hidden treasures within your business and life. We will focus on finding your pearl so you can enjoy doing the things you love the most.

In the aftermath of the COVID-19 pandemic, numerous business owners find themselves grappling with tax debts, causing significant financial strain. Our expert team is dedicated to surmounting these tax debt hurdles by implementing highly effective strategies tailored to your unique circumstances.

If you find yourself being hounded by the Australian Taxation Office (ATO) and have received distressing correspondence and notices, it is crucial to take immediate action.

Did you know that a staggering 80% of errors in small business finances are directly related to bookkeeping and tax? These mistakes can have a significant impact on your bottom line, leading to penalties, fines, and even potential legal consequences.

Running a business is no easy feat. At Oysterhub, we specialise in helping small businesses regain control of their financials— from struggling with bookkeeping, overdue tax lodgements, mounting ATO debts, and dwindling business cashflow. Our tailored solutions are designed to address your specific needs for regaining control and working towards resolving ATO tax debts.

Get in Touch With Our Team of Professional Tax Accountants Today

Our team is accessible in Penrith, Parramatta, and Blacktown, as well as surrounding areas. We offer a wide range of services with the intention of adding value to your finances.

Our expert team is well-versed in small business concerns and can provide customised support that aligns perfectly with your business goals. From strategic financial planning to tax optimisation and cash flow management, we got you covered.

Contact us today to get started.

Lets Have A Chat

We focus on relationships with our clients, being available to answer any business, accounting, or tax questions you have.

"*" indicates required fields

What People Love About Us

I have never found a more passionate finance broker than Vik and his team at Oysterhub. We were about to lose our house when our business took a down shift. Vik saved us from getting a finance deal approved when banks shut the door at us. It's great to work with people who actually care about people not just profits.

I have never seen someone more passionate tax accountant than Adarsh about wanting to help people save time on their menial processes - makes me wonder the experiences in business he has gone through but I'm not complaining I am thankful for it. He is the only tax accountant who has helped me save an extra 8-10 hours per week on lazy accountant tasks and facilitate in enabling me to put these tasks to more productive areas.

- See More