NDIS Provider Accounting & Advisory

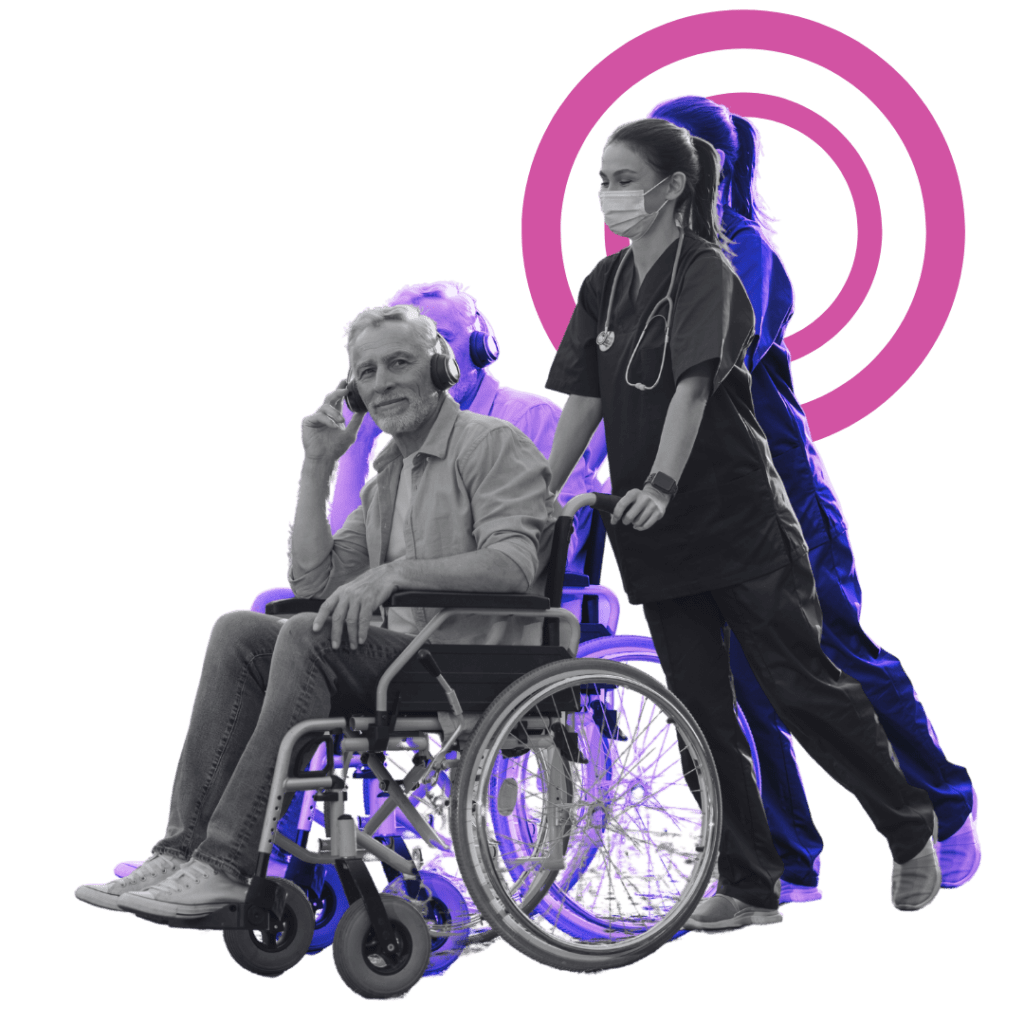

Running a successful NDIS Provider Business is about having the right foundation. Many NDIS Providers face roadblocks due to lacking systems for multi-location NDIS business models.

At Oyster Hub, we are NDIS Specialist Accountants and operational advisors who understand the NDIS jargon for both registered and non-registered providers.

The Importance of NDIS Accounting

The NDIS accountant services empower over 450,000 individuals with disabilities in Australia, ensuring access to essential accounting services. However, managing NDIS accounting complexities, from SCHADS Awards to compliance, requires specialized expertise.

Traditional accountants may not grasp these nuances. At Oyster Hub, our goals include ensuring compliance, optimising financial efficiency, and helping you thrive within the NDIS framework.

Common Challenges Faced By NDIS Providers in Australia

- Managing NDIS Portal Claims and Proda Account

- NDIS Charity Registration & Compliance

- Setting up NDIS Business Structure for Growth

- Understanding NDIS software with cloud accounting

- Understanding Business financial and cashflow

- Scheduling & Rostering Staff and Payroll Timesheets

- Meeting ATO Compliance for Super, Payroll, PAYG and annual tax

- Understanding the SCHADS Awards and applying to Payroll

- Finding an NDIS bookkeeper who can ensure expenses are claimed appropriately

- NDIS Provider Payroll tax compliance and exemptions

- Running out of Participant Funding & Budget Reviews

- Work With Us

Are you Looking for a NDIS Specialist Accountant?

Meet Adarsh, Co-Founder of Oyster Hub, an award-winning accounting firm and winner of the National Accounting Award. As Chief Financial Officer (CFO), he has a strong passion for working with NDIS providers, empowering them to make a positive impact on the lives of people living with disabilities.

Adarsh and his team of tax accountants, business advisors, and financial brokers are experts in their field and possess extensive knowledge and experience.

He has been recognized in various industry publications and events for his dedication to helping business owners find purpose and balance in their professional lives. In a recent campaign by Intuit QuickBooks, he was named “The Wizard of Accounting.”

HOW WE CAN HELP

Why Choose Oyster hub NDIS Accounting

Still thinking if we are a right fit? As part of the Oyster Group of Companies, Oyster Care is a registered NDIS provider employing over 300 employees across NSW. Oyster Tribe is a registered Aboriginal corporation working towards closing the gap, focused on regional development. As part of the Oyster Group strategy, we are committed to a reconciliation plan and delivering services to vulnerable people, with solid financial backing from Oyster Hub.

Learn More About Our Oyster Group

Rescue Catchup Accounting by Our Accountants

Our rescue NDIS accounting process helps NDIS providers owners feeling stuck and dealing with the ATO, complex payroll Tax and SCHEDS Awards Obligations.

Our rescue NDIS accounting process helps small business owners feeling stuck and dealing with the ATO. With our service, here’s how we do it:

- Make A Call: Start your journey to tax savings by calling our team of NDIS accountants. Our NDIS accountant will help you determine if your business is eligible for a Second Opinion.

- Comprehensive Assessment: Our team of accountants thoroughly analyzes your information to identify areas for improvement.

- Second Opinion Report: As accountants, we create a detailed overview of our findings and recommended solutions.

- Report Walkthrough: We will recommend scheduling a 1-hour meeting to go over the Second Opinion Report with you.

NDIS Operational Business Advisory for Clients

Despite substantial NDIS income, many businesses operate at a loss. Our expertise lies in bridging this gap. We help NDIS providers strike the perfect balance, ensuring their income aligns with operational costs. Our services include:

Stay updated with the latest industry standards and regulations through our Schdes Awards Advisory.

Enhance your workforce management and policies with our comprehensive HR review services.

Streamline your administrative tasks and compliance with our efficient Proda Portal support.

Optimise your financial strategy and tax obligations with our expert Payroll Tax Advisory.

Structure your NDIS team Roosting, Scheduling, Team leaders and Management to drive your business.

Working with your business goals, mission and objectives and aligning them to the financial goals for the organisation to succeed.

NDIS Business Charity Setup & Advisory

Most NDIS providers operate for community benefit but often pay unnecessary taxes, putting them in difficult cash flow positions. Our accountants’ advisory service include:

Provides clients with a way to establish effective board meetings and meet ACNC reporting requirements.

Leverage opportunities to maximize financial resources.

Australian taxation laws provide generous tax concessions for not-for-profit organizations.

Insights to management and optimization of payroll tax obligations of the clients.

ACNC Registration - NDIS Provider Tax Exemption

NDIS Charities must be registered with the Australian Charities and Not-for-profits Commission (ACNC) to access charity tax concessions. Benefits include:

- Income Tax Exemption: No need to lodge income tax returns.

- GST Concession: Various GST concessions for endorsed charities.

- DGR Concessions: Generous tax concessions for not-for-profit organizations.

Are you overwhelmed and don’t know what to do? Looking for NDIS accounting services?

NDIS Accounting & Taxation Services for Small Business Owners

Proper accounting and taxation are the foundation of small businesses. Our comprehensive bookkeeper and accounting services are designed to support and keep you on top of your financial records. We help with:

- Annual Company Tax Returns & Financial for Small Business Owners

- Preparation of consolidated reporting for Group Entities

- Lodgement of Fringe benefits tax (FBT) reports

- Lodgement of Small Business Owners Business Activity Statements

- Lodgement of Contractor Reports (TPAR) for Small Business Owners

Bookkeeping & Payroll Services for NDIS Providers

Bookkeeping and payroll management services ensure accurate planning and recording of financial records and payments, empowering informed decision-making. Our services include:

- Fixed Fees for Bookkeeping & Payroll

- Cloud Bookkeeping Software

- Receipt Capturing connected to your software

- Dedicated Bookkeeping Expert

Cloud Accounting Software We Use

Join countless small business owners who have discovered the power of financial efficiency with the leading cloud accounting software providers, such as:

- Xero – Xero is a cloud-based accounting software that simplifies financial management. It’s beneficial as it allows tracking expenses, managing invoices on the go, and keeping accurate financial records. Xero provides efficiency that helps tradies focus on their core activities.

- QuickBooks Online – QuickBooks Online offers features like expense tracking, invoicing, and inventory management. It provides small business owners with an easy-to-use interface and powerful tools to manage finances efficiently.

- MYOB – MYOB offers payroll management, invoicing, and compliance reporting. It’s particularly beneficial as it helps manage finances effectively, ensuring tax obligations are met and cash flow is maintained.

We recommend using cloud accounting solutions for your business, like Xero, QuickBooks Online, and MYOB, to enhance financial accuracy. These tools aid management and marketing strategies, as well as resource allocation for providers and clients alike.

Difference between bookkeeping and accounting

Bookkeeping focuses on recording and organising financial data, while accounting interprets and presents this data to business owners and investors. Key differences:

- Bookkeeping: Intended for payroll, invoicing, receipts, and bills of a business

- Accounting: Utilized for financial statements, budgets, tax returns of a business

NDIS SCHADS Awards

The SCHADS Awards present significant challenges for NDIS providers. Our advisors provide solutions to address compliance issues and provide businesses with operational reviews and payroll audits.

We also offer a way to ensure adherence to regulations. We help with:

- SCHADS Award Pay Point and Award level Interpretation

- Understanding Casual and Full-time Employees Awards

- Regular Compliance Checks and Internal Audits by NDIS Accountants

- Advisory for Payroll Software with SCHADS Awards

NDIS Property Finance

At Oyster Hub, we guide NDIS providers and our clients with disability toward lucrative investments, offering expert assistance to secure plans and funding. Our management in NDIS property finance services includes:

Feeling lost? here are some related tags to help you navigate!

Contact Our NDIS

Experts At Oyster Hub Today!

Ready to transform your NDIS business in Australia? Book a consultation with Oyster Hub’s NDIS accountant today and take the first step towards financial efficiency and compliance for NDIS businesses. With our streamlined service, our team of advisors can support your goals every step of the way!

Lets Have A Chat

We focus on relationships with our clients, being available to answer any business, accounting, or tax questions you have.

"*" indicates required fields