Self Managed Superfund

Oyster Hub empowers families and small business owners to take control of their retirement savings with expert Self Managed Super Fund (SMSF) services

Jump To

Accounting software we work with

HOW TO GET STARTED

Take Control of your Wealth with Self Managed Superfunds

We understand that Self Managed Supefunds SMSFs accounting & taxation can be complex, which is why we offer a range of services tailored to your unique needs and goals.

With Oyster Hub, you can trust that your SMSF is in good hands. We prioritize transparency, compliance, and your long-term financial well-being.

- Work With Us

How we can help streamline your business

We’ve walked in your shoes as small business owners, so we understand the unique hurdles you encounter on your path to growth

Books a FREE Discovery Call

Let’s chat about your business, your goals, and how we can help you achieve financial peace of mind.

Setup Busines Goals

We’ll work together to define clear, actionable financial goals that align with your vision for your business.

Find Your Pearl

We’ll dive deep into your finances to uncover hidden opportunities, tax savings, and strategies to maximize your profits your financial “pearl.”

Your Self Managed Superfunds, Accounting, SMSF Tax Return Experts

As leading SMSF specialists, Oyster Hub provides comprehensive support for your Self Managed Super Fund. We guide you through setup, ongoing administration, and ensure compliance with all ATO reporting obligations. We also prioritize educating you on your trustee responsibilities,

01

Self Managed Superfunds Setup & Reporting

Our Tax Accountants can help you with the business end-of-the-year ATO compliance

We can help ensure your company’s financial health and tax compliance with our comprehensive Company Tax Returns service. Our tax accountants specialize in preparing and lodging business tax returns, ensuring your company tax return is accurate and optimized for your specific business needs. We maximise deductions and minimize your tax liability, so you can focus on running your business with confidence.

Get your SMSF alive in the most tax effective way to facilitate in creating long term wealth.

- SMSF Trust Deed

- Appointment of Trustee Documents

- Trustee Declarations

- SMSF TFN Application

- SMSF ABN Application

- Resolution Minutes for Establishment

SMSF Establishment with Oyster Hub: Your Path to Retirement Success

At Oyster Hub, we make establishing your Self Managed Super Fund (SMSF) simple and stress-free. Our experienced team guides you through every step of the process, ensuring a smooth and efficient journey towards your retirement goals.

Here’s how we help with your SMSF establishment:

- Comprehensive Documentation: We prepare all necessary establishment documents for your review and signature, ensuring your SMSF is set up correctly from the start.

- ATO Registration: We handle the registration of your SMSF with the Australian Taxation Office (ATO), obtaining the required tax file number (TFN) and Australian Business Number (ABN) on your behalf.

- Expert Guidance: Our team provides ongoing support and expert advice throughout the establishment process, addressing any questions or concerns you may have.

- Compliance Assurance: We ensure your SMSF meets all regulatory requirements and ATO standards, giving you peace of mind as you embark on your retirement planning journey.

At Oyster Hub, we understand the importance of accurate and timely financial reporting for your Self Managed Super Fund (SMSF). Our experienced team will handle all aspects of your SMSF’s financial reporting and annual tax returns, ensuring compliance and maximizing your investment returns.

Get your taxes and financial reports in order and meet your trustee obligations to the ATO.

- Cloud Accounting Package

- Detailed Financial Reports

- Profit & Loss Statement

- Member Statements

- Investment Reports

- Trustee Resolutions & Minutes

- SMSF Annual Tax Return Lodgement

- Independent Audit Report

Our experienced team can guide you through the intricacies of borrowing within your Self Managed Super Fund, ensuring compliance with ATO regulations and helping you secure the right financing for your investment goals. We’ll work closely with you to understand your specific needs and find the best loan options available for your SMSF property investment strategy.

Rolling over your existing superannuation into your new Self Managed Super Fund (SMSF) easy. We guide you through the entire process, ensuring a smooth transfer of all or partial funds. Our experts can assist with the additional documentation often required by large funds, so you can set up your SMSF quickly and confidently. With our support, your Self Managed Super Fund is in good hands.

With Oyster Hub, redirecting your employer’s contributions to your Self Managed Super Fund (SMSF) is simple. We’ll provide you with the necessary documents, including a completed Superannuation Standard Choice Form and confirmation of your fund’s regulated status with the Australian Taxation Office. We’ll also guide you on how to provide your employer with your fund’s Electronic Service Address (ESA), ensuring seamless and timely contributions to your SMSF.

Let Oyster Hub simplify the process of redirecting your employer contributions so you can focus on building your retirement nest egg in your Self Managed Super Fund.

Our tax accountants will simplify the setup of your Self Managed Super Fund (SMSF). Our expert team handles the paperwork, ensures ATO compliance, and guides you through the process, ensuring a smooth start to your retirement savings journey.

A SMSF is a private superannuation fund, regulated by the Australian Taxation Office (ATO) that you manage yourself. SMSFs can have up to four members. All members must be trustees (or directors, if there is a corporate trustee) and are responsible for decisions made about the fund and compliance with relevant laws. Set up costs and annual running expenses can be high, so it’s most cost-effective if you have a large balance.

By law, if you or another trustee of your self-managed super fund becomes bankrupt, that person can no longer remain a trustee, director or member of the super fund. SMSFs have a 6-month grace period to remove the bankrupt trustee and make arrangements to deal with their super assets.

If you are the only member of your SMSF, a new director will need to be appointed to manage the fund on your behalf while you are disqualified.

Seek legal advice about the actions you need to take to deal with bankruptcy and your SMSF.

An SMSF is a legal tax structure whose sole purpose is to provide for your retirement. SMSFs operate under similar rules and restrictions as ordinary super funds.

When you run your own SMSF you must:

- carry out the role of trustee or director, which imposes important legal obligations on you

- set and follow an investment strategy that is appropriate for your risk tolerance and is likely to meet your retirement needs

- have the financial experience and skills to make sound investment decisions

- have enough time to research investments and manage the fund

- budget for ongoing expenses, such as professional accounting, tax, audit, legal and financial advice

- keep comprehensive records and arrange an annual audit by an approved SMSF auditor

- organise insurance, including income protection and total and permanent disability cover for super fund members

- use the money only to provide retirement benefits.

Important

If you decide to set up an SMSF, you are personally liable for all the decisions made by the fund – even if you get help from a professional or another member makes the decision.

In June 2018, ASIC released its findings from a review of the SMSF sector. The review found that around 90% of financial advice about setting up an SMSF did not comply with relevant laws. Other findings included that, among SMSF trustees:

- 38% said running their SMSF was more time-consuming than expected

- 32% said the set-up and running costs were more than they expected

- 29% incorrectly thought they were entitled to compensation for theft and fraud involving their SMSF.

Running your own super fund is a major commitment. Before setting up an SMSF, ask yourself:

Have you considered other do-it-yourself (DIY) super options?

Many professionally managed super funds have DIY investment options which let you choose specific assets, such as shares, exchange traded funds and term deposits. This gives you some control over your investments without the legal and administrative responsibilities of running an SMSF.

Have you considered other super funds or investment options?

If you’re thinking about setting up an SMSF because you’re not happy with your current fund or the way your money is invested, consider changing to another fund or investment option first. See choosing a super fund.

Will your self-managed fund outperform your current fund?

Super funds use highly skilled professionals to invest your money. Will the investments you choose perform better than your professionally managed super fund? Are you confident you can accurately measure returns?

Have you considered the costs?

Like all super funds, SMSFs have costs associated with running the fund, including investing, accounting and auditing. If these costs are high they could have a significant impact on your retirement lifestyle.

Having access to a broader range of investments is a common reason for starting an SMSF. Through a self-managed super fund, you can not only invest in shares, term deposits, managed funds and property, you can also hold alternative assets, such as antiques and artwork.

Shares

You may want to set up an SMSF so you can choose your own shares. But, unless you have a lot of money to invest, you are unlikely to be as diversified as a fund manager, who has the advantage of using pooled funds to buy a broad range of shares.

Some APRA-regulated funds now allow you to choose your own shares.

Property

Some people use their SMSF to invest in property. For information on the rules of property investment within super and the costs involved, go to our SMSFs and property webpage.

Collectibles

SMSFs can hold collectibles such as artwork, jewellery, antiques, coins, stamps, vintage cars and wine; however, there are very strict rules around holding these assets in your SMSF.

The assets must be insured and they cannot provide a present‑day benefit. This means that artwork cannot be displayed in your home or business, you cannot drive the vintage car, you cannot wear the jewellery or drink the wine.

For more information, see the ATOs webpage on collectibles and personal use assets.

Cryptocurrencies

Some SMSF trustees have taken an interest in investing in cryptocurrencies such as Bitcoin, Ethereum, Litecoin and Ripple. While SMSFs are not prohibited from investing in cryptocurrencies, as a trustee, you need to consider:

- the nature of cryptocurrencies – For a detailed explanation on what they are and how they work, see our webpage on cryptocurrencies

- cryptocurrency risks – Cryptocurrencies carry additional risks, including fewer safeguards, values that can fluctuate significantly over a short period of time and the risk that your money could be stolen with little or no recourse

- SMSF regulatory requirements – There are superannuation regulatory requirements that apply to investments made by your SMSF. For more information about SMSFs investing in cryptocurrencies, visit the ATO website.

Be wary of services offering to establish an SMSF for you in order to gain exposure to cryptocurrencies. Not only does operating an SMSF involve significant time, skills and responsibility, you may also be putting your retirement savings at risk.

You should seek independent advice from a licensed financial adviser before undertaking any new type of investment in your fund.

How SMSF trustees invest

SMSF trustees prefer different assets from those of APRA-regulated super funds, which may impact returns. SMSFs tend to invest more in cash, property and alternative assets while APRA-regulated funds are usually better diversified.

Get a independent advice for your investment strategies with your financial planner.

02

FAQ Self Managed Superfunds

Oyster Hub: Your partner in SMSF compliance. Learn your trustee responsibilities and avoid fines and penalties with our expert guidance

With Oyster Hub, you can trust that your SMSF’s financial reporting and tax compliance are in expert hands. We’ll work with you to ensure your fund is operating efficiently and effectively, helping you achieve your retirement goals.

03

Problems We Solve for Small Business Owners

Feeling overwhelmed by tax problems and frustrated with unresponsive accountants who offer no real guidance for your business growth? We understand.

Problems We Solve: Feeling Stuck with Overdue Accounting and Tax Obligations? Let Us Rescue Your Business. Our catch-up accounting service is designed specifically for small business owners who need to catchup on overdue work. We’ll handle your overdue filings, reconcile your accounts, and help you get compliant with the ATO, so you can focus on running your business.

How to Know You Need Rescue ?

- Your current Accountant & Bookkeeper is not responsive

- You have received failure to lodge ATO fines & penalties

- You have been issued with Director’s Penalty Notice (DPN)

- You have outstanding ATO Debt and Lodgements

- You are looking for business direction to scale

- You are behind on bookkeeping & paperwork

Problems We Solve: Concerned your tax return didn’t meet expectations? Is your accountant making you overpay taxes? Let our Award Winning Tax Accountants review your business tax returns, and potentially recover overpaid taxes. Get the peace of mind you deserve, knowing you’re maximising your tax savings.

How We Can Help with Second Opinion.

- Review Accounting & Bookkeeping

- Reverse Overpaid tax

- Create Tax Saving Plan

Problems We Solve: Is ATO debt holding your business back? Struggling with cash flow and worried about the impact on your family? Don’t let mounting tax debt cripple your business and personal life. Seek expert help today to regain control, manage your debt, and secure a brighter future.

- Negotiating Payment Arrangement.

- Remissions of Fines and Penalties

- Deal with ATO on Your Behalf

- Avoid Further Fines and Penalties

Learn More About ATO Payment Plan

Problems we Solve: Is your ATO debt stressing your business and impacting your family’s well-being? Don’t let it sink your livelihood. Talk to our tax experts today about ATO debt negotiation. We’ll help you regain control, improve cash flow, and protect your future.

- Small Business Restructuring (SBR)

- Negotiating ATO Debt on Your Behalf

- Tax Debt Finance Options

- Seek ATO Debt Release.

Learn More About Tax Debt Negotiating

We provide expert solutions for your toughest tax problems. From catch-up accounting to ATO debt negotiation, we’ll get your finances back on track and help your business thrive. Talk to Our Award Winning Accountants today. (02) 9158 5444 or Book a Call

#Oysterhub Meaning

The world is full of opportunities for you to maximise in order to live your life to the utmost extent alike to an Oyster! However finding out what the world has to offer that is specifically for you is a bit trickier and is your pearl and that is where we come into help you find your pearl together!

Feeling lost? here are some related tags to help you navigate!

Why Choose Oyster Hub Wizard Accountants ?

Managing your business’s finances can be overwhelming. With Oyster Hub, our award-winning accountants can provide expert aid and support to help you expand your business while maintaining complete tax compliance.

When you work with us, you are bound to get the best results. Whether you need help with bookkeeping, tax planning, or financial reporting, we’ve got you covered.

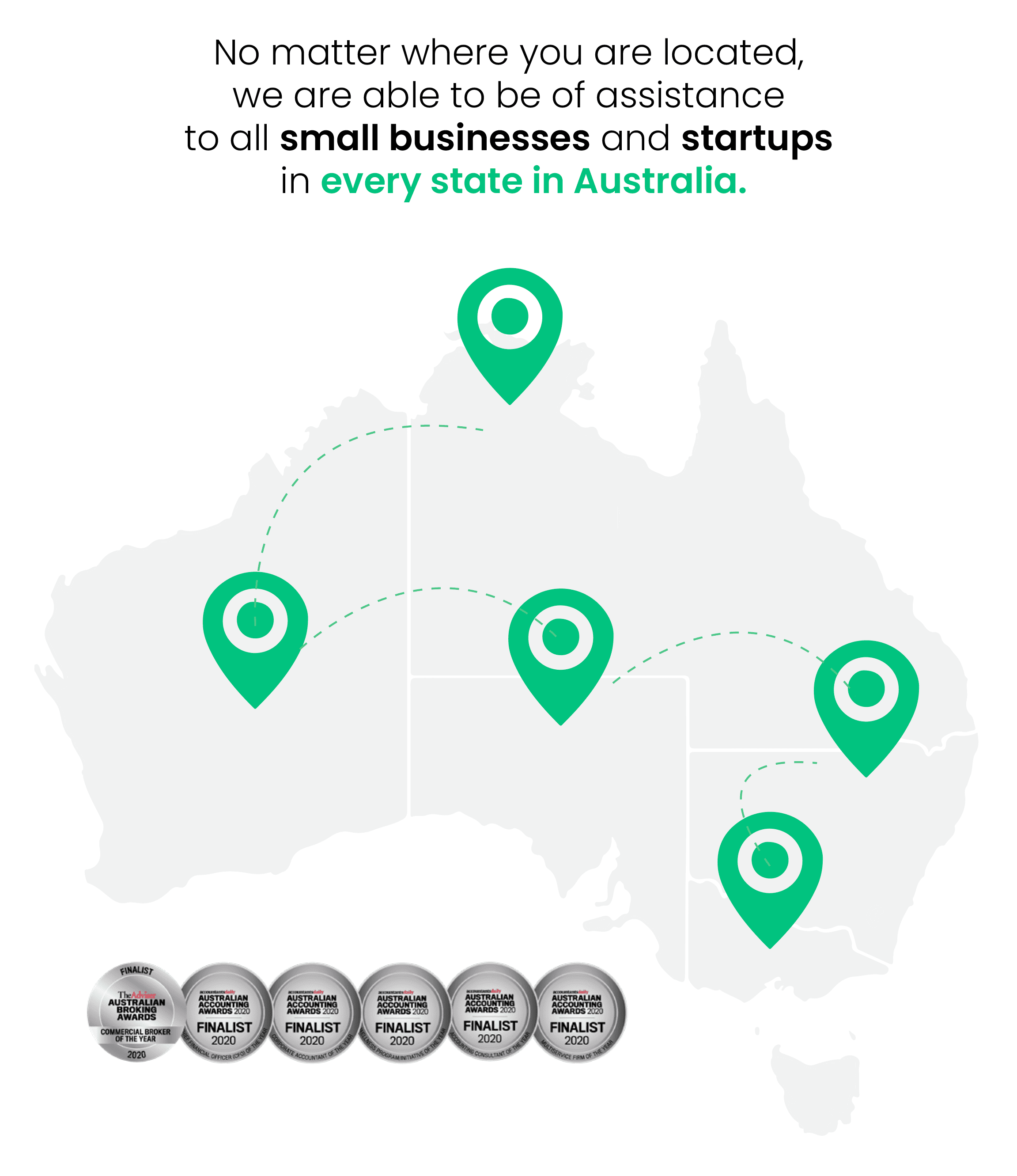

Oysterhub understands the importance of effective communication for successful business operations. Our team of experts is well-versed in cloud technology and proficient in utilizing video conference platforms like Zoom and Microsoft Teams Meetings so you can you can connect and collaborate with us seamlessly from anywhere you are.

Oysterhub does not only take your small business and startup to new heights. We empower every small business owner to unlock their inner wizardry, enabling them to achieve their goals while making a profound social impact in their communities.

Moreover, we are proud advocates of the UN’s Sustainable Development Goals— inspiring our clients to amplifying their value and impact while driving positive change in the world.

Every businesses comes face to face with unique challenges when it comes to managing their accounting, bookkeeping, and finance needs. Our team of experienced professionals go beyond simply crunching numbers and tailor our services accordingly, allowing you to focus on what matters most: driving your small business towards unparalleled growth and scalability.

Sorting out payroll, taxes, and accounts can be an arduous task and could be better spent on completing new projects.

Countless clients have experienced a significant boost in revenue by redirecting their focus back into their core operations while allowing our skilled accountants to handle their financial matters. When you partner with us today, you will experience the difference our expertise can make for your business while providing additional support to fuel your business’s growth.

Clear financial records are the compass that guides successful businesses towards profitability. At Oyster Hub, our experienced accountants specialise in putting your financial records back on track.

In a world brimming with opportunities, we believe that every individual and business possesses a unique Pearl waiting to be discovered.

From managing budgets to optimizing staff resources and closely monitoring your profit and loss, we provide the insights you need to drive your business forward.

Let Oyster Hub be your trusted guide in uncovering the hidden treasures within your business and life. We will focus on finding your pearl so you can enjoy doing the things you love the most.

In the aftermath of the COVID-19 pandemic, numerous business owners find themselves grappling with tax debts, causing significant financial strain. Our expert team is dedicated to surmounting these tax debt hurdles by implementing highly effective strategies tailored to your unique circumstances.

If you find yourself being hounded by the Australian Taxation Office (ATO) and have received distressing correspondence and notices, it is crucial to take immediate action.

Did you know that a staggering 80% of errors in small business finances are directly related to bookkeeping and tax? These mistakes can have a significant impact on your bottom line, leading to penalties, fines, and even potential legal consequences.

Running a business is no easy feat. At Oysterhub, we specialize in helping small businesses regain control of their financials— from struggling with bookkeeping, overdue tax lodgements, mounting ATO debts, and dwindling business cashflow. Our tailored solutions are designed to address your specific needs for regaining control and working towards resolving ATO tax debts.

Get a SECOND rescue opinion for your Small Business for your previous year’s tax returns if you have PAID High Tax Bills.

We find that most business owners are heading toward a business crisis if they identify the following in your business.

Drowning In Paperwork

Low Business Cashflow

Paying High Tax Bills

Accountant is working like a sloth

Need an expert wizard?

Come and have a chat with our friendly staff about your next big steps.

Feeling lost? here are some related tags to help you navigate!

GET TO KNOW US MORE

Learn more about our Award Winning Service

Your business is a journey; create an impact and build a business that has a purpose to make a difference to your family, community, and yourself. We have put together everything you need to know about how we create an impact at Oyster Hub with ‘Your Journey with Oyster Hub Guide.’ Download the PDF and learn more about how you can create an impact in your business

Previous

Small Business Tax Accounting

Next

What People Love About Us

I have never found a more passionate finance broker than Vik and his team at Oysterhub. We were about to lose our house when our business took a down shift. Vik saved us from getting a finance deal approved when banks shut the door at us. It's great to work with people who actually care about people not just profits.

I have never seen someone more passionate tax accountant than Adarsh about wanting to help people save time on their menial processes - makes me wonder the experiences in business he has gone through but I'm not complaining I am thankful for it. He is the only tax accountant who has helped me save an extra 8-10 hours per week on lazy accountant tasks and facilitate in enabling me to put these tasks to more productive areas.

- See More